For a long time, I was a dedicated GetGo user as the convenience was hard to beat as I loved that many Getgo cars are in good and clean conditions. I also wrote an article comparing Getgo vs. BlueSG:

Car Rental Companies Review: Getgo Vs. BlueSG

However, I was involved in a car accident last year and my Getgo account was suspended for 2 weeks while investigation was ongoing. That is when I started exploring other car-sharing apps and eventually settled on Car Lite.

What I Like About Car Lite?

1. Better Hourly Rates ($5.20 vs $6.00)

It might seem like a small difference, but the math adds up fast. Most of my standard bookings are around $5.20 per hour on Car Lite, compared to the $6.00 per hour base rate I was seeing on GetGo for similar economy models, e.g. Mazda 3. If you’re renting for a full afternoon, that’s essentially a free drink or snack saved just on the time charge alone.

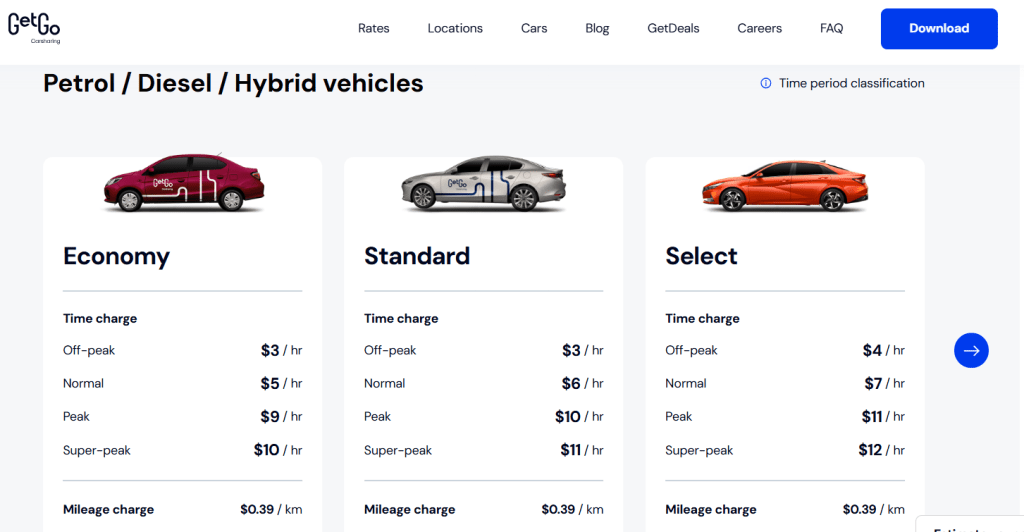

Getgo Rates (Mazda 3):

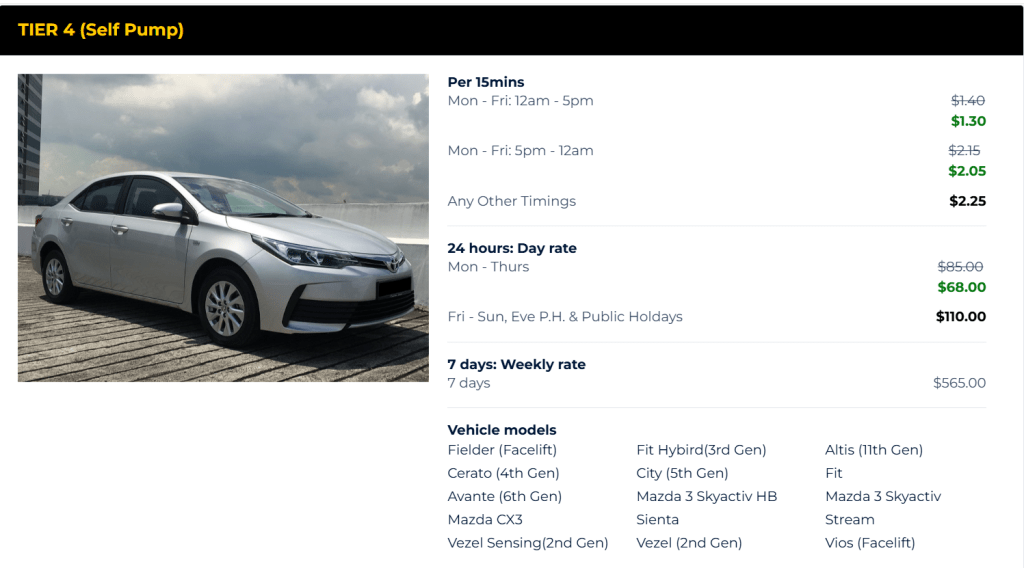

Carlite Rates (Mazda 3):

2. Massive Savings on Mileage (0.288/km vs 0.39/km)

The mileage fee is where GetGo usually hits the hardest. At $0.39/km, a 20km round trip to the mall or a friend’s place costs $7.80. On Car Lite, the rate is significantly lower at roughly $0.288/km.

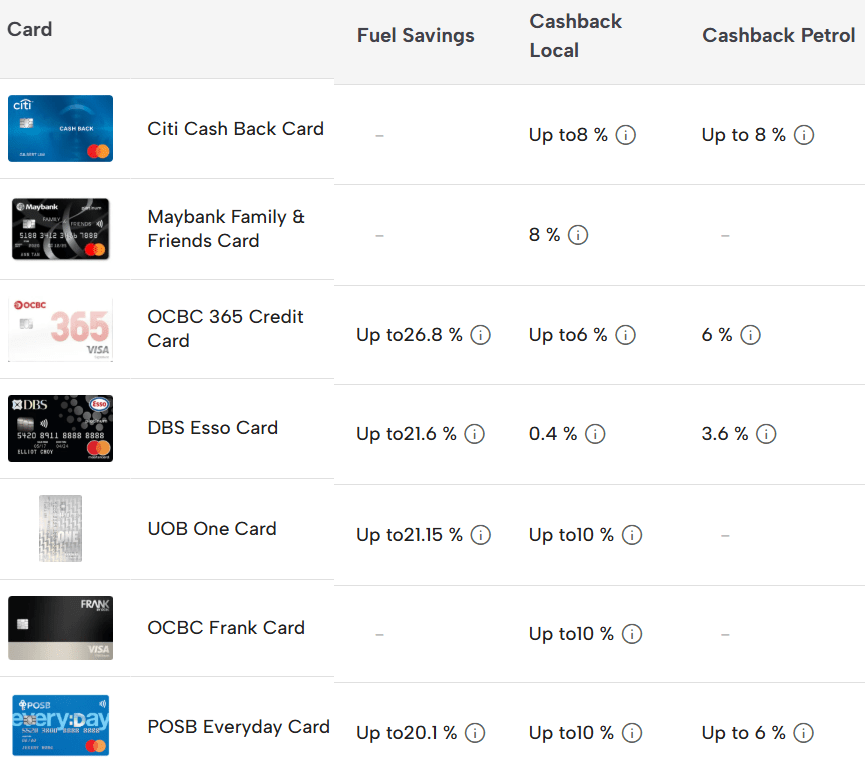

The Math: On a 50km trip, I save over $5.10 just on fuel/mileage charges. Over a month of weekend errands, that’s a huge chunk of change back in my pocket. With credit card discount on fuel charges factored in, the savings are more significant.

3. Ultimate Flexibility: The 15-Minute Rule

This is the real game-changer. GetGo requires a minimum booking of 1 hour. If I just need to zip to the market or drop off a heavy parcel (a 10-minute job) or send my child to school which is 7 mins drive away, I still have to pay for the full hour. Car Lite allows for 15-minute booking blocks. I only pay for the time I actually need, which has effectively quarter the cost of my short-distance “ninja” runs, i.e. $1.30 vs. $6.00.

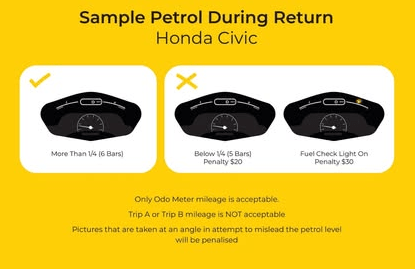

4. The “Free Fuel” Bonus (1/4 Tank Policy)

With Car Lite, you aren’t forced to top up the tank as long as it’s at 1/4 tank or more when you return it. I’ve found that many previous hirers are generous (or just want to be safe) and leave the car with more than 1/4 tank, which can cover the short drive.

Since you pay for your own fuel at the kiosk (or via the mileage tier), you often benefit from the “excess” fuel left behind by the person before you. It feels like a little reward for being part of a community that looks out for each other.

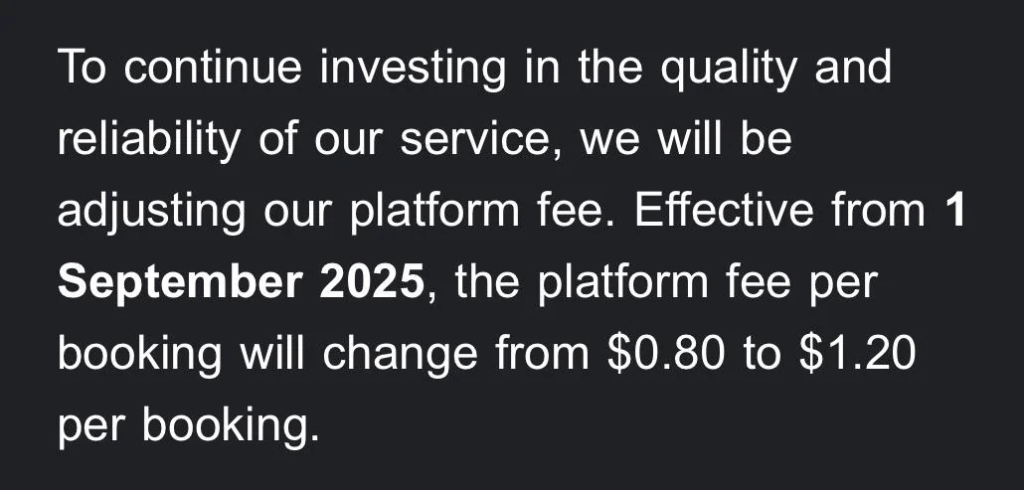

5. Zero Platform Fees

Every time you hit “Book” on GetGo, there’s a $1.20 platform fee tacked onto the bill. It feels like a hidden “booking tax.” Car Lite has no platform fee, meaning the price you see for the rental is the price you actually pay.

Concluding Thought

By switching to Car Lite, I’ve managed to reduce my car-sharing expenses by about 20-30% per month without changing my driving habits. If you’re tired of seeing those $1.20 fees and high mileage charges add up, it might be time to give Car Lite a try.

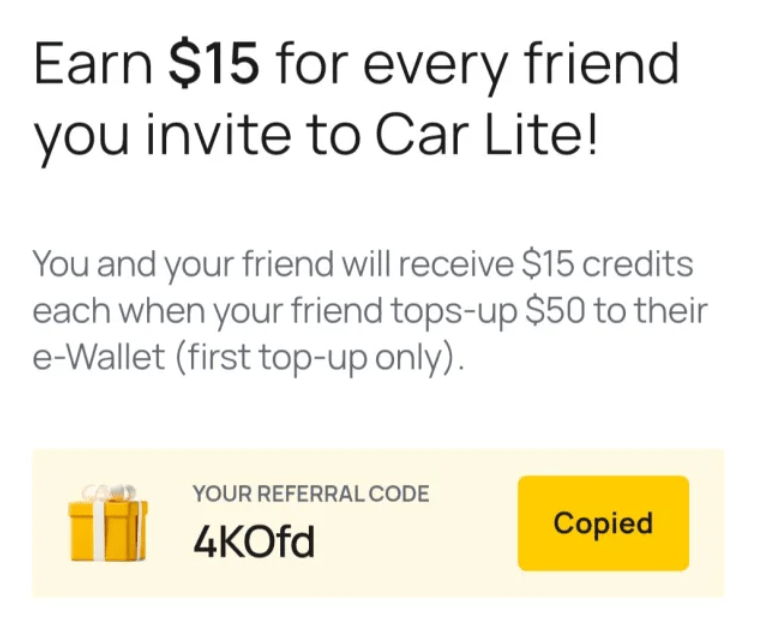

If you would like to try out Car Lite, you can use my referral code (4KOfd) for a $15 credits into your account when you top up $50 into your wallet.

While Car Lite is my No. 1 choice for car rental, I still use Getgo because there are more cars around, especially during peak hours or last minute bookings, when the available Car Lite vehicles are all fully booked.

*** SEE MY TRADES & PORTFOLIO ON PATREON ***

If you are interested to find out more about my options trades and investment portfolio, I will be updating them on Patreon (on the same day I made the trades), so do follow me there if you need some reference or inspiration.

Click here to access my Patreon page

*** BUY ME A CUP OF COFFEE ***

If my blog has benefited you in some ways and you would like to offer a token of appreciation, you may do so via this page. Thank you very much for your support!

*** FINANCE BOOKS ***

If you are new to investing, options trading or personal finance and would like to get yourself educated about the fundamentals, you may want to consider these very popular and highly recommended books: One Up On Wall Street, The Psychology of Money, Rich Dad Poor Dad,

*** EARN FREE MONEY ***

Sign up for WeBull Securities Brokerage and sure-win free shares:

Receive Free Money When You Sign Up With WeBull Securities Platform

*** FREE BEGINNER GUIDE TO OPTIONS TRADING ***

Keen to learn about options trading but do not wish to pay for expensive courses, this newbie guide will help gain the knowledge and fundamentals to understand options better. And it’s totally free!

The Newbie’s Guide To Options Trading

*** FREE MOTIVATIONAL BOOK ***

If earning more money from your investment does not excite you anymore, you may be seeking a purpose that brings fulfillment and meaning in life. I have written a motivational book that may be useful to you in some ways. You can also download a free copy here:

https://learninginvestmentwithjasoncai.com/finding-the-magical-realm-of-happiness-motivational-book

*** FOLLOW US ON SOCIAL MEDIA ***

Follow me on Facebook and LinkedIn, to get notified of my latest posts on social media. Or subscribe to my blog (scroll to the bottom of the page) to have my new posts sent directly to your mailbox.

We also have a community passionate about investing, trading, and personal finance over our Telegram or Facebook group. So, join us there for a good discussion, post queries, or simply share your financial knowledge.

*** MUST-READ BLOG POSTS ***

The day that I lost everything….

I Was Margin Called, IBKR Liquidated ALL My Positions & Realised S$540k (USD400k) Worth Of Losses

Sharing these 6 fatal mistakes in investing and options trading so you can avoid these pitfalls

The 6 Fatal Investing/ Trading Mistakes That Made Me Lose More Than $1M

After accumulating more than 600k of unrealized losses on my portfolio, I wrote this article to encourage friends and investors who are also losing a lot of money to the market.

If You Are Feeling Depressed From Losing Lots Of Money In The Stock Market, Here’s An Article For You

The precious 6 lessons I learnt after cutting more than half a million of losses in the stock market through bad investments and risky trades.

6 Lessons Learnt After Losing 551k In 10 Years Of Investing & Options Trading | What Newbies Should Know They Start Investing/ Trading

In the 10 years of my investing journey, I have made many mistakes but also learned many lessons from these mistakes. I compiled the 10 most valuable lessons that I have learned and may they help you succeed in your investing journey.

Happy 10 Years Of Investing | 348k (Realised) Profit, 635k (Unrealized) Loss & 10 Lessons Learnt

How I managed to build a 1M investment/ trading portfolio despite coming from humble beginnings.

How A Poor Kid Got To A 1M Investment Portfolio | Tips & Principles Of Building Wealth

I did these 10 side hustles while holding a full-time job, so I share them here so you can be inspired to grow your wealth through a side hustle that you enjoy.

I Did These 10 Side Hustles While Working Full Time | 10 Side Hustle Ideas To Help You Earn An Extra Income

Struggling with inflation and high cost of living? Try these 10 methods to help you save money and accumulate more savings for investments or rainy days.

10 Ways To Save Money To Help You Fight Inflation & Rising Costs Of Living

Why I am building $120,000 of cash reserves in Singapore Savings Bonds (SSB) & 5 reasons why I think SSB is a worthy low or zero-risk investment that you can consider.

Why I Am Building $120,000 Of Cash Reserves In Singapore Savings Bonds (SSB)? | 5 Reasons Why SSB Is A Worthy Low-Risk Investment