The cost of living can get pretty insane in developed cities like Singapore. Without a conscious effort to watch our spending, we may not enough one day as inflation and high interest rates cannot be covered by our slow rising salaries.

Besides, if we do not learn how to save, our high salaries may not even be enough for us to splurge on luxuries and unnecessary purchases. With good money habits, the lower income earner may save more money than his higher income earner peers. Take for example, a person earning $5k per month but only spends $2k saves more money than a person earning $10k per month but spends $8k.

In this article, I wish to share 5 money saving methods that have helped me save hundreds of dollars each month. I hope you find them useful too.

Method 1: Rent A Car Instead of Buy A Car

Singapore is the most expensive country to own a car. In an article by Dollars and Sense, the price of owning a Toyota Altis over 10 years in 2023 is $230,000, which includes COE, road tax, insurance, servicing, parking, ERP and petrol. That works out to be $23,000 per year or $1,916 per month.

I use the car every day during weekdays to fetch my child to school as there is no school bus available due to the long distance. Instead of buying a car and paying close to $2k per month, I choose to rent a car for my daily commuting needs.

A hour rental in the morning and another hour rental in the evening are sufficient to fetch my child to school and back and it costs around $25 for both trips. Multiple that by 22 weekdays in a month, it will adds up to $550. My weekend bookings usually do not exceed more than $300 per month, so my total spending on car rental per month is about $850, which is a saving of more than $1k per month.

I previously did a review on the 2 companies that I have rented car from and they are Getgo and BlueSG. I would strongly recommend Getgo and you can find out the reasons why in this article:

Car Rental Companies Review: Getgo Vs. BlueSG

Method 2: Avoid Ordering Food Delivery

I used to order food delivery quite often, especially on every Sunday as our family rests at home. However, I soon realised that it is quite expensive to be ordering from food delivery, because the food prices are already inflated (more expensive than the menu outside, probably to factor in GST and other misc costs). Also, there is a minimum order (e.g. $12) to fulfill and on top of that, there is delivery charges.

I am living in a matured estate, where there is a supermarket and 4 coffeeshops in the vicinity. So, what I did was to switch to more homecooked food or takeaways at the zi char stalls or mixed vege economical rice stall. By stopping my ordering using food delivery services, I saved about an average of $60 per week, which added up to a total of $240 per month.

Method 3: Buy Shoes, Sports Equipment At Decathlon

Decathlon is an amazing place where you can find good quality sports equipment and accessories at affordable prices. I bought my sport shoes, my child’s school shoes, all our sport stuff (soccer ball, basket ball, badminton racket, soccer boots, bicycles) at prices lower than the usual sports shops out there.

Take for example, we bought this shoe from BATA at $39.95 and it was spoilt after barely 2 months of wearing.

We bought a replacement pair of shoes at Decathlon, which was half the price and after more than 4 months of wearing, it is still in good condition.

Method 4: Switch From Attending Enrichment Classes To Self-Learning

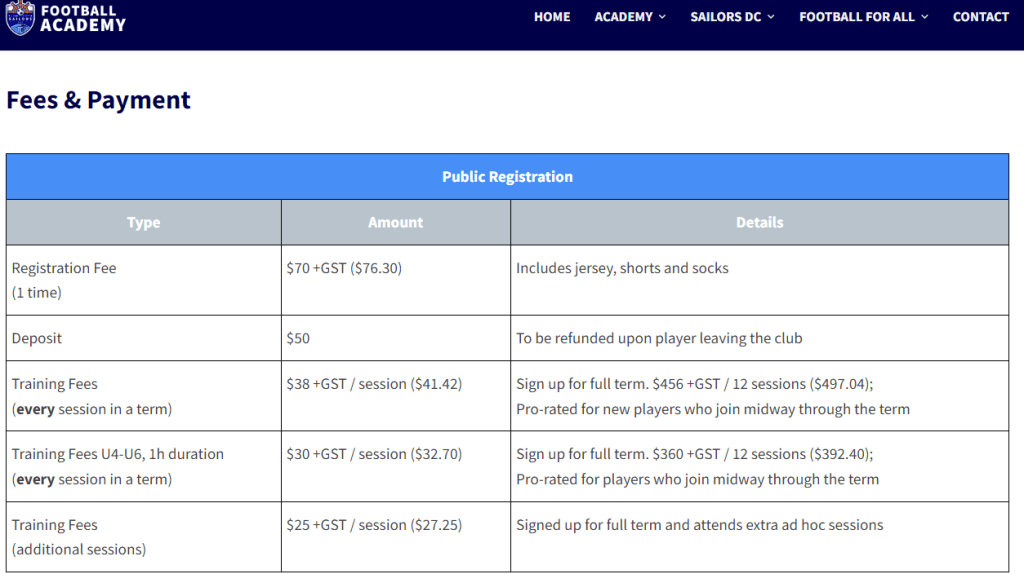

As Singaporean parents, we are sometimes too keen to load our children with enrichment activities to bring the best out of them. However, that comes at a cost because such enrichment activities, be it swimming, sports, martial arts, robotics classes, are not cheap to begin with.

I sent my child for swimming class previously and it was $30 per lesson. However, considering car rental and parking fees, the cost of each lesson became $60. Thus, I spent around $240 per month for my child’s swimming classes.

As my child was not making much progress after learning the basics, I decided to withdraw him from the lesson and teach him myself, as I was previously from the swim team in my schooling days. Other than saving up on the swimming fees, I was able to spend more time bonding with him, instead of waiting at the side for him to finish his lessons. I also coached my child on soccer, instead of sending him for soccer classes and that also helped me save up hundreds each month.

Method 5: Buy Essential Stuff Online

There are many online platforms that offer deals that are much cheaper than retails stores. I ordered our family’s vitamins and supplements through iHerb instead of buying them from retail shops like LAC. I also ordered bath soap, shampoo for both adult and children from iHerb.

Buying items from Taobao has also helped my family save up a lot, as compared to buying them from the shops in shopping centers. The things I bought include clothes, toys, books, bags, water bottles, paper envelopes, craft materials, electrical appliances and many essential items that we need.

Concluding Thoughts

Some people may think that saving money is difficult because everything is expensive. The reality is that there are items that we may unknowingly overpaid and continue to do so because we are too used to using them and do not take time to re-evaluating our expenses regularly. I hope this article provides you with some enlightenment that you will find useful in your journey of building wealth.

If you are keen on this topic of personal finance and money saving methods, do check out my other related articles that I have shared previously.

10 Ways To Save Money To Help You Fight Inflation & Rising Costs Of Living

*** SEE MY TRADES & PORTFOLIO ON PATREON ***

If you are interested to find out more about my options trades and investment portfolio, I will be updating them on Patreon (on the same day I made the trades), so do follow me there if you need some reference or inspiration.

*** EARN FREE MONEY ***

Sign up for WeBull Securities Brokerage and sure-win free shares:

Receive Free Money When You Sign Up With WeBull Securities Platform

*** FREE BEGINNER GUIDE TO OPTIONS TRADING ***

Keen to learn about options trading but do not wish to pay for expensive courses, this newbie guide will help gain the knowledge and fundamentals to understand options better. And it’s totally free!

The Newbie’s Guide To Options Trading

*** FREE MOTIVATIONAL BOOK ***

If earning more money from your investment does not excite you anymore, you may be seeking a purpose that brings fulfillment and meaning in life. I have written a motivational book that may be useful to you in some ways. You can also download a free copy here:

https://learninginvestmentwithjasoncai.com/finding-the-magical-realm-of-happiness-motivational-book

*** FOLLOW US ON SOCIAL MEDIA ***

Follow me on Facebook, LinkedIn, to get notified of my latest posts on social media. Or subscribe to my blog (scroll to the bottom of the page) to have my new posts sent directly to your mailbox.

*** BUY ME A CUP OF COFFEE ***

If my blog has benefited you in some ways and you would like to offer a token of appreciation, you may do so via this page. Thank you very much for your support!

*** MUST-READ BLOG POSTS ***

After accumulating more than 600k of unrealized losses on my portfolio, I wrote this article to encourage friends and investors who are also losing a lot of money to the market.

If You Are Feeling Depressed From Losing Lots Of Money In The Stock Market, Here’s An Article For You

In the 10 years of my investing journey, I have made many mistakes but also learned many lessons from these mistakes. I compiled the 10 most valuable lessons that I have learned and may they help you succeed in your investing journey.

Happy 10 Years Of Investing | 348k (Realised) Profit, 635k (Unrealized) Loss & 10 Lessons Learnt

The precious 6 lessons I learnt after cutting more than half a million of losses in the stock market through bad investments and risky trades.

6 Lessons Learnt After Losing 551k In 10 Years Of Investing & Options Trading | What Newbies Should Know They Start Investing/ Trading

How I managed to build a 1M investment/ trading portfolio despite coming from humble beginnings.

How A Poor Kid Got To A 1M Investment Portfolio | Tips & Principles Of Building Wealth

I did these 10 side hustles while holding a full-time job, so I share them here so you can be inspired to grow your wealth through a side hustle that you enjoy.

I Did These 10 Side Hustles While Working Full Time | 10 Side Hustle Ideas To Help You Earn An Extra Income

Struggling with inflation and high cost of living? Try these 10 methods to help you save money and accumulate more savings for investments or rainy days.

10 Ways To Save Money To Help You Fight Inflation & Rising Costs Of Living

Why I am building $120,000 of cash reserves in Singapore Savings Bonds (SSB) & 5 reasons why I think SSB is a worthy low or zero-risk investment that you can consider.

Why I Am Building $120,000 Of Cash Reserves In Singapore Savings Bonds (SSB)? | 5 Reasons Why SSB Is A Worthy Low-Risk Investment

Sharing why I am doing Dollar Cost Average (DCA) into SPY and QQQ ETF for long-term investments and a step-by-step guide to doing it automatically with Interactive Brokers.

Why I Am Doing DCA (Automatically) For SPY & QQQ For My Long Term Investment? (20% ~ 30% Upside Potential) | Step By Step Guide To Activating Automatic Recurring Investment On IBKR

Can options trading provide you with extra sideline income every month? In this post, I share my experience of generating income from options trading over the last 3 years.

Options Trading For Passive Income: Truth Or Myth?