April became the month when the US market started to experience a correction and even the mightiest Nvidia experienced a 10% drop in a single day and for a brief period, dropped to USD700+ range.

Concerns over sticky inflation, and tension in the Middle East, have rocked investors’ confidence as share prices started to correct.

For April, I have made a profit of S$3,463 and in this article, I wish to share with you the trades and may you find it useful as a reference to you.

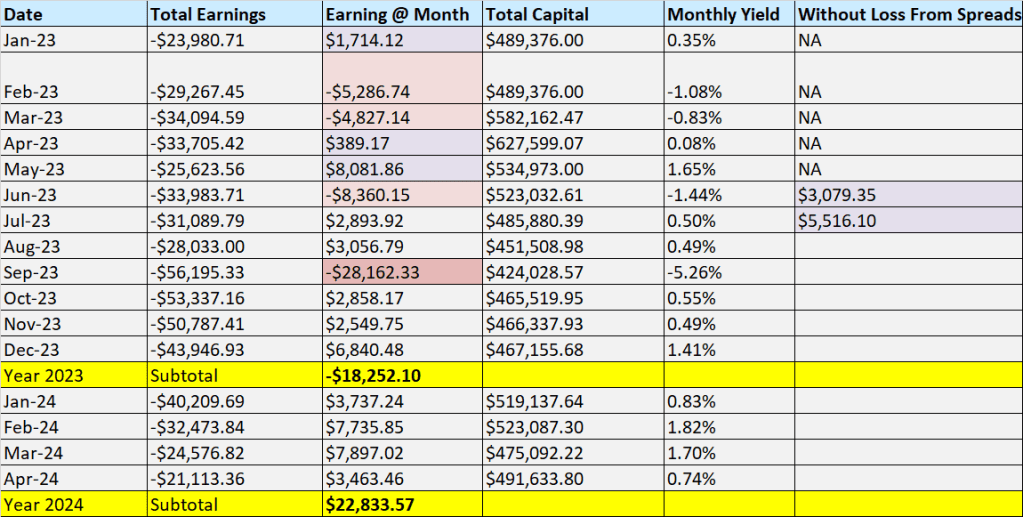

The summary table of profit/ loss is as follows:

The total profits could have been more if I had not needed to cut loss on Tesla’s bearish positions after the stock had 2 significant rises after earnings and Elon Musk’s visit to China. At one stage, my SELL CALL and BUY PUT positions were quite profitable when Tesla’s share price was dropping by the day, before its fortunes reversed.

The details of all my trades can be found here:

The bigger wins of this month come from closing my Tesla Covered CALL positions that I have held for a long time (since early 2023) and my Micron CALL positions.

[1 April 24] +USD520 Profits In 6 days, Closing MU Trade Positions

[16 April 24] +USD755 Profits, Closed Tesla Covered CALL Position

[16 April 24] +USD738 Profits, Closed Tesla CC Position

If you wish to be updated on my trades as they happen, you can follow me on my Patreon page, I usually update on the same day or latest by the following day.

Click here to access my Patreon Page

I have also grouped all my profitable trades in one collection (album) so it is easier for reference.

Buying LEAPS CALL

In this month, I started buying LEAPS CALL into 2 stocks that reported good earnings but gave below expectation guidance, and they are Meta and AMD. These 2 stocks are among the strongest companies in the world and have great prospects in the AI-driven world. Their stock prices had significant drops after earnings were released. As such, I thought it was a good opportunity to buy long-term CALL options (LEAPS CALL) to give the share price ample time to recover back to its All-Time-High (ATH) prices.

[2 May 24] Bought 1 x LEAPS CALL on AMD

[25 April 24] Bought 1 x LEAPS CALL on Meta

Buying Shares

I also bought some Nvidia shares as the share price dipped to cover up for my shortfall positions in Nvidia. I currently own 124 shares with an average price of USD369.70 against the 2 CALL contracts that I sold.

Lastly, I bought 6 units of QQQ and SPY as the prices correct, with an average price of USD500.74 for SPY and USD422.72 for QQQ as the market corrects. I take this investment as a store of cash as these two index funds would return to their ATH prices sooner or later. So, it is safe to park my money there, for the short term or long term. The index funds would purge out the poor performers and add in better performers every year.

Options Trading Strategies For April 24

The strategies that I used for April 24 are the Selling Covered CALL, SOP Strategy, BULL CALL Spread Strategy, and buying OTM CALL/ PUT options, with the first being the most effective this month.

Further Read:

Why Are CALL and PUT Options Commonly Known As Covered CALL and Cash Secured PUT?

My Options Trading Strategy For 2023 | Introducing SOP Options Trading Strategy

How Does Bull CALL Spread Work? | CALL Debit Spread Explained For Newbies

Concluding Thought

The past few months have given me good returns in trading and I have cut down my total losses in options trading (since Feb 21) to around S$21k, which is good progress considering I once cut more than S$400,000 of losses in options trading.

Hopefully, by the time I reach my 4th year of options trading in 2025, I can break even and have zero losses. If that happens, it means I took 4 years to lose everything and to win back again and go back to square 1. The things that are valuable (since there were no profits) are the lessons learned and experience gained.

*** SEE MY TRADES & PORTFOLIO ON PATREON ***

If you are interested to find out more about my options trades and investment portfolio, I will be updating them on Patreon (on the same day I made the trades), so do follow me there if you need some reference or inspiration.

*** EARN FREE MONEY ***

Sign up for WeBull Securities Brokerage and sure-win free shares:

Receive Free Money When You Sign Up With WeBull Securities Platform

*** FREE BEGINNER GUIDE TO OPTIONS TRADING ***

Keen to learn about options trading but do not wish to pay for expensive courses, this newbie guide will help gain the knowledge and fundamentals to understand options better. And it’s totally free!

The Newbie’s Guide To Options Trading

*** FREE MOTIVATIONAL BOOK ***

If earning more money from your investment does not excite you anymore, you may be seeking a purpose that brings fulfillment and meaning in life. I have written a motivational book that may be useful to you in some ways. You can also download a free copy here:

https://learninginvestmentwithjasoncai.com/finding-the-magical-realm-of-happiness-motivational-book

*** FOLLOW US ON SOCIAL MEDIA ***

Follow me on Facebook, LinkedIn, to get notified of my latest posts on social media. Or subscribe to my blog (scroll to the bottom of the page) to have my new posts sent directly to your mailbox.

*** BUY ME A CUP OF COFFEE ***

If my blog has benefited you in some ways and you would like to offer a token of appreciation, you may do so via this page. Thank you very much for your support!

*** MUST-READ BLOG POSTS ***

After accumulating more than 600k of unrealized losses on my portfolio, I wrote this article to encourage friends and investors who are also losing a lot of money to the market.

If You Are Feeling Depressed From Losing Lots Of Money In The Stock Market, Here’s An Article For You

In the 10 years of my investing journey, I have made many mistakes but also learned many lessons from these mistakes. I compiled the 10 most valuable lessons that I have learned and may they help you succeed in your investing journey.

Happy 10 Years Of Investing | 348k (Realised) Profit, 635k (Unrealized) Loss & 10 Lessons Learnt

The precious 6 lessons I learnt after cutting more than half a million of losses in the stock market through bad investments and risky trades.

6 Lessons Learnt After Losing 551k In 10 Years Of Investing & Options Trading | What Newbies Should Know They Start Investing/ Trading

How I managed to build a 1M investment/ trading portfolio despite coming from humble beginnings.

How A Poor Kid Got To A 1M Investment Portfolio | Tips & Principles Of Building Wealth

I did these 10 side hustles while holding a full-time job, so I share them here so you can be inspired to grow your wealth through a side hustle that you enjoy.

I Did These 10 Side Hustles While Working Full Time | 10 Side Hustle Ideas To Help You Earn An Extra Income

Struggling with inflation and high cost of living? Try these 10 methods to help you save money and accumulate more savings for investments or rainy days.

10 Ways To Save Money To Help You Fight Inflation & Rising Costs Of Living

Why I am building $120,000 of cash reserves in Singapore Savings Bonds (SSB) & 5 reasons why I think SSB is a worthy low or zero-risk investment that you can consider.

Why I Am Building $120,000 Of Cash Reserves In Singapore Savings Bonds (SSB)? | 5 Reasons Why SSB Is A Worthy Low-Risk Investment

Sharing why I am doing Dollar Cost Average (DCA) into SPY and QQQ ETF for long-term investments and a step-by-step guide to doing it automatically with Interactive Brokers.

Why I Am Doing DCA (Automatically) For SPY & QQQ For My Long Term Investment? (20% ~ 30% Upside Potential) | Step By Step Guide To Activating Automatic Recurring Investment On IBKR

Can options trading provide you with extra sideline income every month? In this post, I share my experience of generating income from options trading over the last 3 years.

Options Trading For Passive Income: Truth Or Myth?