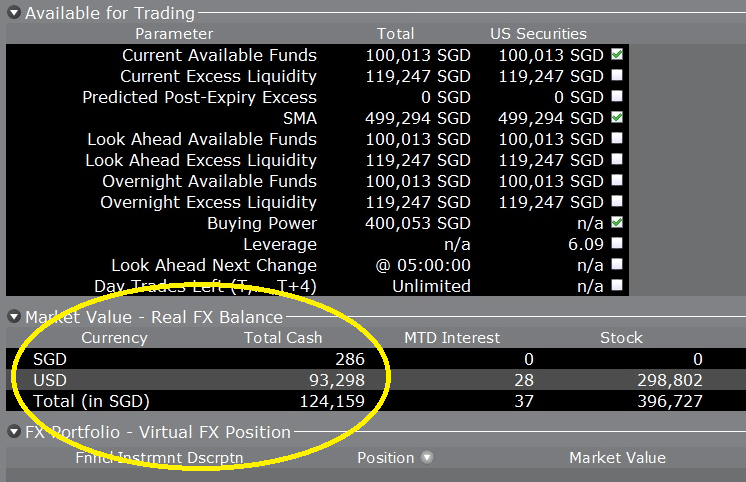

On 11 Jan 24, while logging into my brokerage account, I was surprised to find a notification that I was at risk of going into margins (not enough cash left and the brokerage has to lend money to you). I was surprised as I had more than 124k of cash sitting in my account earning interest.

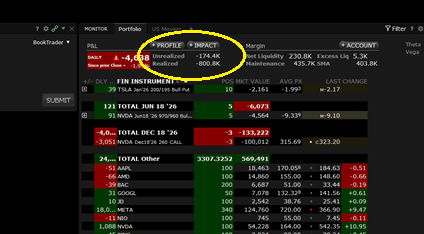

When I finally logged into my trading account, I got a rude shock when I saw this:

My +$124k turned into -$127k overnight. Next, I saw this:

A realized loss of -800k!

I knew something must have gone wrong with one of my trade positions, where I sold a BULL PUT spread on Meta at strike prices of USD720/710. For this trade, the maximum loss should be only USD200.

What Happened?

I called my brokerage to find out what actually happened.

As it turns out, the SELL PUT leg of my Meta vertical BULL PUT spread was exercised early (2 years ahead of time). As I had 20 contracts, I was assigned 2000 shares of Meta at USD720, which means I had to buy these shares at a whopping USD1.44M!

As my account was not able to support such a big amount, I was given a margin call through a notification on my IBKR app but I missed that out totally. When the market opened the following day, IBKR proceeded to liquidate some of my positions to make it margin-compliant again.

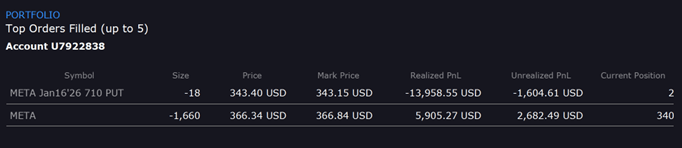

So, IBKR liquidated 1660 shares of Meta at USD366.34 and 18 of my BUY PUT contracts at USD343.15 each, to raise USD608.12k and USD618.12k respectively. As it was still insufficient, all the cash inside my account was deducted, and I was in -127k of margins.

This also explains why I had a realised loss of -800k as 1660 shares were purchased at the strike price of USD720 but later sold at the market price of USD366.34.

If I Had Seen The Margin Call

If I had seen the notification of the margin call, I would have activated the BUY PUT leg of the contract and sold off my 2000 Meta shares to get a maximum loss of USD200 for the 20 contracts. However, as IBKR sold off 18 of my 20 options contracts, I was unable to exercise the right to sell off all my shares at USD710.

At the time of my call with IBKR customer service, if I were to sell off all my option contracts (remaining 2) and the rest of my 340 Meta shares, I would have incurred a loss of more than USD500, instead of the max loss of USD200. This is because the options were not exercised timely to cap the max loss at USD200. Instead, the option contracts were sold off due to the liquidation. On top of that, I was charged interest on my margin loan of USD96.058k for a day, which worked out to USD18.

What Actions Did I Take Thereafter?

After my conversation with IBRK customer service, I began to plan what was my next course of action. As I had previous experiences with early exercise on one leg of my vertical spread, I learned not to panic and sell off everything all at once. I observed that Meta’s share price was rising on 10 Jan and decided to take a bullish approach to sell off my shares and option contracts.

I sold off my remaining 2 BUY PUT contracts as they were bearish in nature and I was left with 340 Meta shares. I then further sold away 140 Meta shares to make my account positive again and got out of my margin loan.

I worked out that my breakeven price for my remaining 20 Meta shares was USD370.50. I waited for the right opportunity to finally sell my remaining 200 shares at USD372 and made a profit of USD300 (instead of a loss of USD500 if I had panicky sold after my conversation with IBKR customer service), which turned out to be a happy ending after going through a rollercoaster ride of emotions that night.

What To Do When You Get A Margin Call?

My first advice would be not to panic when you get a margin call.

If you are using IBKR, call these hotlines to find out what happened that caused you to be issued a margin call. Then, find ways to top up your account to avoid being in a cash deficit (negative balance).

Even if you can only top up your cash to cover the deficit, i.e., turn from negative back to positive cash balance, in a few days, it is alright as you will only be charged interest on those few days.

How To Prevent Liquidation?

It is important to note that the brokerage has the right to liquidate any positions, not just the ones that cause you to get a margin call, to make sure your account goes back to margin-compliant. So, if you do not wish to lose some of your precious positions or realize a loss on them, it is important to learn how to prevent liquidation after a margin call has been issued.

If you manage to catch the notifications to inform you that your option contracts get assigned early, what you can do is exercise the other leg of your vertical spread before the market opens on the following day. This will allow the brokerage to execute your order when the market closes, and they will work out the cash deficit so that you will not be liquidated on your positions.

Alternatively, you can sell away your shares in pre-market to raise the cash that you need to cover your cash deficit. By doing so, you will avoid liquidation as there will be ample cash to cover the shortfall in your account.

How To Prevent A Margin Call From Happening?

From this episode, I realise it is important to pay attention to the notifications/ emails that your brokerage has sent you. I used to ignore them because most of them were FYI messages, and then I missed out on the margin call totally.

We should be prepared for the day when an option contract that we sell gets exercised ahead of time (American style) and thus ensure there is enough money (if you are selling PUT) or you have shares (if you are selling CALL) to cover ourselves should that happen.

I am using my margins account for selling PUT, so I do not need to have the capital upfront to buy 100 shares before I open a SELL PUT position. However, if it gets assigned prematurely, then I will need to find the cash to top up my account if it is insufficient. That is the reason why I left more than 100k cash in my account to not just earn interest but also be prepared if any of my contracts get assigned.

Concluding Thoughts

It was an emotional rollercoaster when the incident happened and I was really lost for a while when I saw the -127k cash balance and the realized loss of -800k. I thought I had lost those amounts in a single night, which was more devastating than losing more than half a million in the last 10 years.

I hope my experience is useful to anyone who may face or is facing this situation. If you think that there is a risk of your account being margin-called or getting liquidated, start taking preventive measures now to lower your risk. If you are doing risky trades, then be very careful that you may get margin calls and get liquidated on the positions you do not wish to sell.

I think it is not worth getting in such a situation because it is very stressful, especially when you know that certain trades cannot be reverted or you are unable to get enough cash to cover yourself (for naked trades).

If you have further queries, please feel free to ask in the comments, so I can help to answer them.

*** SEE MY TRADES & PORTFOLIO ON PATREON ***

If you are interested to find out more about my options trades and investment portfolio, I will be updating them on Patreon (on the same day I made the trades), so do follow me there if you need some reference or inspiration.

*** EARN FREE MONEY ***

Sign up for WeBull Securities Brokerage and sure-win free shares:

Receive Free Money When You Sign Up With WeBull Securities Platform

*** FREE BEGINNER GUIDE TO OPTIONS TRADING ***

Keen to learn about options trading but do not wish to pay for expensive courses, this newbie guide will help gain the knowledge and fundamentals to understand options better. And it’s totally free!

The Newbie’s Guide To Options Trading

*** FREE MOTIVATIONAL BOOK ***

If earning more money from your investment does not excite you anymore, you may be seeking a purpose that brings fulfillment and meaning in life. I have written a motivational book that may be useful to you in some ways. You can also download a free copy here:

https://learninginvestmentwithjasoncai.com/finding-the-magical-realm-of-happiness-motivational-book

*** FOLLOW US ON SOCIAL MEDIA ***

Follow me on Facebook, LinkedIn, to get notified of my latest posts on social media. Or subscribe to my blog (scroll to the bottom of the page) to have my new posts sent directly to your mailbox.

*** JOIN OUR FINANCE COMMUNITY ***

Join our community on Facebook to discuss anything under the sun relating to personal finance, investing, and options trading. Come learn from one another the financial knowledge that can change your life.

*** BUY ME A CUP OF COFFEE ***

If my blog has benefited you in some ways and you would like to offer a token of appreciation, you may do so via this page. Thank you very much for your support!

*** MUST-READ BLOG POSTS ***

After accumulating more than 600k of unrealized losses on my portfolio, I wrote this article to encourage friends and investors who are also losing a lot of money to the market.

If You Are Feeling Depressed From Losing Lots Of Money In The Stock Market, Here’s An Article For You

In the 10 years of my investing journey, I have made many mistakes but also learned many lessons from these mistakes. I compiled the 10 most valuable lessons that I have learned and may they help you succeed in your investing journey.

Happy 10 Years Of Investing | 348k (Realised) Profit, 635k (Unrealized) Loss & 10 Lessons Learnt

The precious 6 lessons I learnt after cutting more than half a million of losses in the stock market through bad investments and risky trades.

6 Lessons Learnt After Losing 551k In 10 Years Of Investing & Options Trading | What Newbies Should Know They Start Investing/ Trading

How I managed to build a 1M investment/ trading portfolio despite coming from humble beginnings.

How A Poor Kid Got To A 1M Investment Portfolio | Tips & Principles Of Building Wealth

I did these 10 side hustles while holding a full-time job, so I share them here so you can be inspired to grow your wealth through a side hustle that you enjoy.

I Did These 10 Side Hustles While Working Full Time | 10 Side Hustle Ideas To Help You Earn An Extra Income

Struggling with inflation and high cost of living? Try these 10 methods to help you save money and accumulate more savings for investments or rainy days.

10 Ways To Save Money To Help You Fight Inflation & Rising Costs Of Living

Why I am building $120,000 of cash reserves in Singapore Savings Bonds (SSB) & 5 reasons why I think SSB is a worthy low or zero-risk investment that you can consider.

Why I Am Building $120,000 Of Cash Reserves In Singapore Savings Bonds (SSB)? | 5 Reasons Why SSB Is A Worthy Low-Risk Investment

Sharing why I am doing Dollar Cost Average (DCA) into SPY and QQQ ETF for long-term investments and a step-by-step guide to doing it automatically with Interactive Brokers.

Why I Am Doing DCA (Automatically) For SPY & QQQ For My Long Term Investment? (20% ~ 30% Upside Potential) | Step By Step Guide To Activating Automatic Recurring Investment On IBKR

Can options trading provide you with extra sideline income every month? In this post, I share my experience of generating income from options trading over the last 3 years.

Options Trading For Passive Income: Truth Or Myth?