For the better part of three years, the AI narrative has been synonymous with Nvidia (NASDAQ: NVDA). Their GPU roadmap—stretching from the current Hopper and Blackwell architectures to the anticipated Rubin series—has provided the essential scaffolding for the generative AI boom.

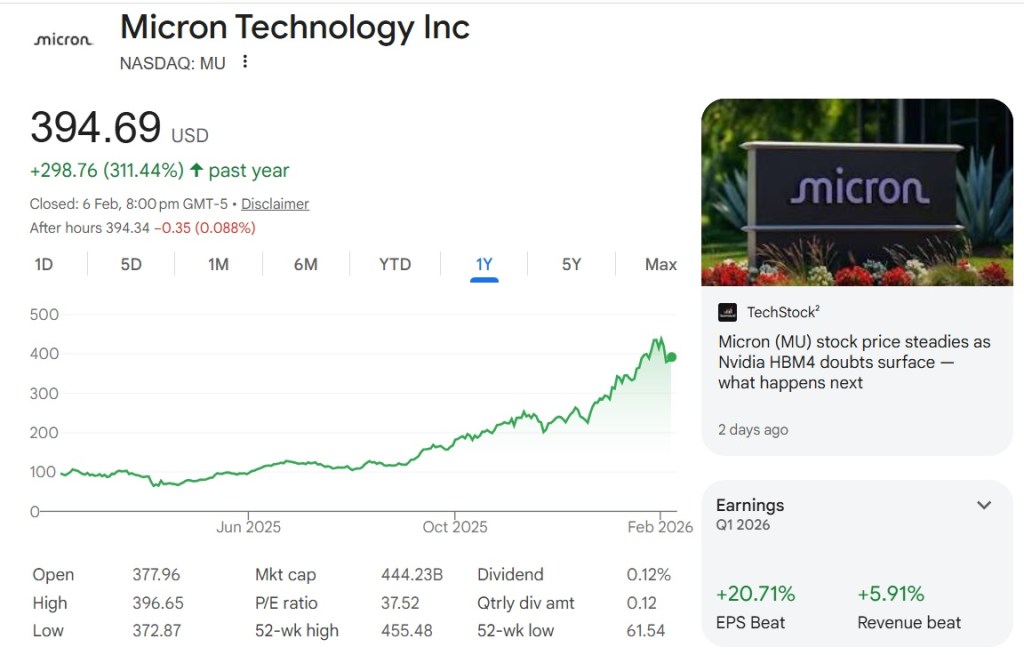

However, the spotlight is broadening. Micron Technology (NASDAQ: MU) has recently emerged as a favorite among analysts, following a trajectory that looks remarkably similar to Nvidia’s early ascent.

Understanding Micron’s Role in the AI Ecosystem

The AI hardware sector is composed of several distinct layers:

- General-Purpose GPUs: Companies like Nvidia and AMD produce versatile hardware designed for high-speed data processing.

- Custom Silicon (ASICs): Broadcom leads the way in specialized chips, which tech giants like Meta and Alphabet use for hyper-specific deep learning tasks.

- The Memory Essential: This is where Micron shines. As AI models grow in complexity, they require massive amounts of High-Bandwidth Memory (HBM), DRAM, and NAND storage to function.

Bloomberg Intelligence projects the AI accelerator market will hit $604 billion by 2033, growing at a 16% CAGR. This secular shift is a massive tailwind for Micron, which dominates the memory landscape. While Micron’s addressable market was roughly $35 billion in 2025, leadership expects that figure to nearly triple to $100 billion by 2028. Interestingly, the demand for memory is currently outpacing the growth of the GPU market itself.

The Surge in Memory Pricing

Why are memory costs skyrocketing? The answer lies in the aggressive capital expenditure of “hyperscalers.” Big Tech is on track to pour over $500 billion into AI infrastructure this year alone. This spending spree has triggered a severe shortage of HBM. Consequently, TrendForce predicts that prices for DRAM and NAND could spike by 60% and 38% respectively in just the first quarter, significantly boosting the profit margins for suppliers like Micron.

Read The Full Article On Our Patreon Page

*** SEE MY TRADES & PORTFOLIO ON PATREON ***

If you are interested to find out more about my options trades and investment portfolio, I will be updating them on Patreon (on the same day I made the trades), so do follow me there if you need some reference or inspiration.

Click here to access my Patreon page

*** BUY ME A CUP OF COFFEE ***

If my blog has benefited you in some ways and you would like to offer a token of appreciation, you may do so via this page. Thank you very much for your support!

*** FINANCE BOOKS ***

If you are new to investing, options trading or personal finance and would like to get yourself educated about the fundamentals, you may want to consider these very popular and highly recommended books: One Up On Wall Street, The Psychology of Money, Rich Dad Poor Dad,

*** EARN FREE MONEY ***

Sign up for WeBull Securities Brokerage and sure-win free shares:

Receive Free Money When You Sign Up With WeBull Securities Platform

*** FREE BEGINNER GUIDE TO OPTIONS TRADING ***

Keen to learn about options trading but do not wish to pay for expensive courses, this newbie guide will help gain the knowledge and fundamentals to understand options better. And it’s totally free!

The Newbie’s Guide To Options Trading

*** FREE MOTIVATIONAL BOOK ***

If earning more money from your investment does not excite you anymore, you may be seeking a purpose that brings fulfillment and meaning in life. I have written a motivational book that may be useful to you in some ways. You can also download a free copy here:

https://learninginvestmentwithjasoncai.com/finding-the-magical-realm-of-happiness-motivational-book

*** FOLLOW US ON SOCIAL MEDIA ***

Follow me on Facebook and LinkedIn, to get notified of my latest posts on social media. Or subscribe to my blog (scroll to the bottom of the page) to have my new posts sent directly to your mailbox.

We also have a community passionate about investing, trading, and personal finance over our Telegram or Facebook group. So, join us there for a good discussion, post queries, or simply share your financial knowledge.

*** MUST-READ BLOG POSTS ***

The day that I lost everything….

I Was Margin Called, IBKR Liquidated ALL My Positions & Realised S$540k (USD400k) Worth Of Losses

Sharing these 6 fatal mistakes in investing and options trading so you can avoid these pitfalls

The 6 Fatal Investing/ Trading Mistakes That Made Me Lose More Than $1M

After accumulating more than 600k of unrealized losses on my portfolio, I wrote this article to encourage friends and investors who are also losing a lot of money to the market.

If You Are Feeling Depressed From Losing Lots Of Money In The Stock Market, Here’s An Article For You

The precious 6 lessons I learnt after cutting more than half a million of losses in the stock market through bad investments and risky trades.

6 Lessons Learnt After Losing 551k In 10 Years Of Investing & Options Trading | What Newbies Should Know They Start Investing/ Trading

In the 10 years of my investing journey, I have made many mistakes but also learned many lessons from these mistakes. I compiled the 10 most valuable lessons that I have learned and may they help you succeed in your investing journey.

Happy 10 Years Of Investing | 348k (Realised) Profit, 635k (Unrealized) Loss & 10 Lessons Learnt

How I managed to build a 1M investment/ trading portfolio despite coming from humble beginnings.

How A Poor Kid Got To A 1M Investment Portfolio | Tips & Principles Of Building Wealth

I did these 10 side hustles while holding a full-time job, so I share them here so you can be inspired to grow your wealth through a side hustle that you enjoy.

I Did These 10 Side Hustles While Working Full Time | 10 Side Hustle Ideas To Help You Earn An Extra Income

Struggling with inflation and high cost of living? Try these 10 methods to help you save money and accumulate more savings for investments or rainy days.

10 Ways To Save Money To Help You Fight Inflation & Rising Costs Of Living

Why I am building $120,000 of cash reserves in Singapore Savings Bonds (SSB) & 5 reasons why I think SSB is a worthy low or zero-risk investment that you can consider.

Why I Am Building $120,000 Of Cash Reserves In Singapore Savings Bonds (SSB)? | 5 Reasons Why SSB Is A Worthy Low-Risk Investment