I shared in a previous post that I had a huge position in Nvidia other than shares, SELL PUT & SELL CALL contracts and they are my BULL CALL Spread contracts that I have invested USD26k of my capital.

More details here: My USD26k Bet On Nvidia

On 11 Oct 24 & 15 Oct 24, I closed those positions for a good profit of USD10.47k. In this post, I will take you through to how I achieved and persisted when things did not go according to plan.

How It Started?

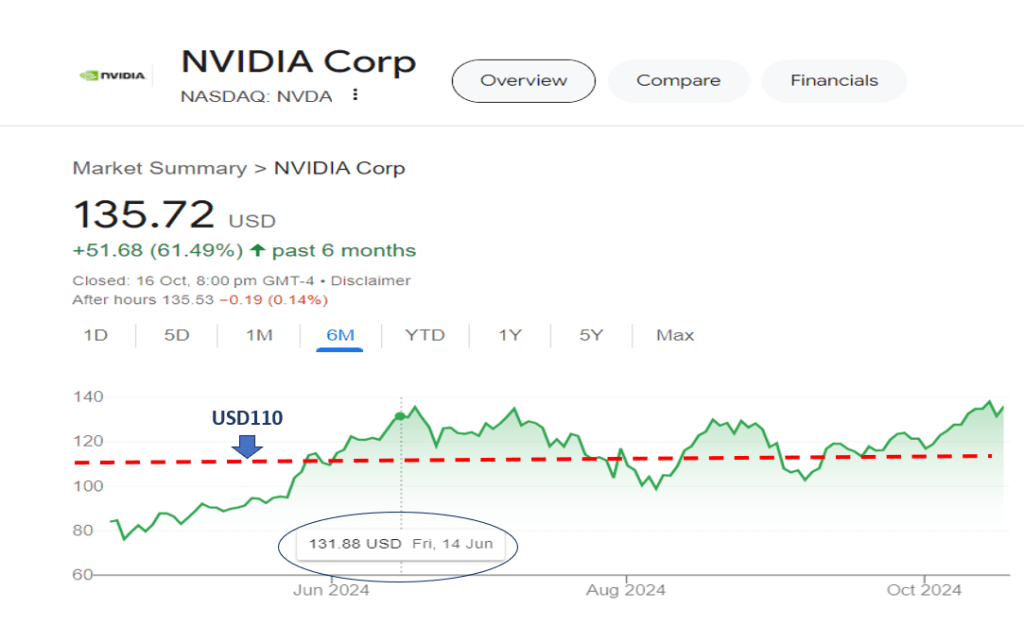

On 14 June 24, I started building up my BULL CALL Spread positions when Nvidia was trading around USD130+. I chose the USD110/108 strike prices to give myself a safety margin, just in case Nvidia drops below USD130.

The expiration date was set at Nov 24 as it was a seasonally bullish month and the US election would have concluded by then (more certainty which the market loves when the US president is decided by then). The chosen strike prices mean that I will get max profit if Nvidia closes above USD110 on expiration date or max loss if Nvidia closes below USD108.

However, things did not always go according plan as Nvidia started to correct going into July and corrected further in Aug, when the contract turned from ITM to OTM, which means I will lose all my capital if Nvidia drops below USD108 by expiration date.

As Nvidia’s share price started to dip, I add on more contracts at the following share prices that Nvidia was trading at:

131.76, 135.8, 126.8, 124.31, 124.8, 127.39, 111, 104.56, 110, 117.63, 121.72

I eventually accumulated 200 positions of BCS 108/110 expiration 15 Nov 24, with an average price of USD132 per contract. On 11 Oct, I closed all 200 positions for a profit of USD9.64k.

More details: [11 Oct 24] +USD9.64k Profits, Closed My Nvidia BULL CALL Spreads

On 26 August 24, I also started another Nvidia BCS position with more conservative strike prices of USD99/97. I added more positions when Nvidia was trading at the following strike prices:

126.3, 121, 122.86, 133.04

I eventually accumulated 60 positions with an average price of USD168 per contract.

On 15 Oct 24, I closed them all for a profit of USD830.

[15 Oct 24] +USD830 Profits, Sold Nvidia BCS Positions

I share all my trades on the same that I made them on my Patreron page, you can follow me there for real-time updates and references.

Concluding Thoughts

The Bull CALL Spread strategy gives a good win-rate because options buyer can profit when share price is increasing, stays stagnant or has a slight dip. I prefer to use it over Selling Cash Secured PUT because it is less capital intensive as well as over buying CALL options because time decay will eat away the premium even if the share price rises eventually.

*** SEE MY TRADES & PORTFOLIO ON PATREON ***

If you are interested to find out more about my options trades and investment portfolio, I will be updating them on Patreon (on the same day I made the trades), so do follow me there if you need some reference or inspiration.

*** FINANCE BOOKS ***

If you are new to investing, options trading or personal finance and would like to get yourself educated about the fundamentals, you may want to consider these very popular and highly recommended books: One Up On Wall Street, The Psychology of Money, Rich Dad Poor Dad,

*** EARN FREE MONEY ***

Sign up for WeBull Securities Brokerage and sure-win free shares:

Receive Free Money When You Sign Up With WeBull Securities Platform

*** FREE BEGINNER GUIDE TO OPTIONS TRADING ***

Keen to learn about options trading but do not wish to pay for expensive courses, this newbie guide will help gain the knowledge and fundamentals to understand options better. And it’s totally free!

The Newbie’s Guide To Options Trading

*** FREE MOTIVATIONAL BOOK ***

If earning more money from your investment does not excite you anymore, you may be seeking a purpose that brings fulfillment and meaning in life. I have written a motivational book that may be useful to you in some ways. You can also download a free copy here:

https://learninginvestmentwithjasoncai.com/finding-the-magical-realm-of-happiness-motivational-book

*** FOLLOW US ON SOCIAL MEDIA ***

Follow me on Facebook, LinkedIn, to get notified of my latest posts on social media. Or subscribe to my blog (scroll to the bottom of the page) to have my new posts sent directly to your mailbox.

We also have a community passionate about investing, trading and personal finance over our Facebook group. So, join us there for a good discussion, post queries or share your financial knowledge.

*** BUY ME A CUP OF COFFEE ***

If my blog has benefited you in some ways and you would like to offer a token of appreciation, you may do so via this page. Thank you very much for your support!

*** MUST-READ BLOG POSTS ***

After accumulating more than 600k of unrealized losses on my portfolio, I wrote this article to encourage friends and investors who are also losing a lot of money to the market.

If You Are Feeling Depressed From Losing Lots Of Money In The Stock Market, Here’s An Article For You

In the 10 years of my investing journey, I have made many mistakes but also learned many lessons from these mistakes. I compiled the 10 most valuable lessons that I have learned and may they help you succeed in your investing journey.

Happy 10 Years Of Investing | 348k (Realised) Profit, 635k (Unrealized) Loss & 10 Lessons Learnt

The precious 6 lessons I learnt after cutting more than half a million of losses in the stock market through bad investments and risky trades.

6 Lessons Learnt After Losing 551k In 10 Years Of Investing & Options Trading | What Newbies Should Know They Start Investing/ Trading

How I managed to build a 1M investment/ trading portfolio despite coming from humble beginnings.

How A Poor Kid Got To A 1M Investment Portfolio | Tips & Principles Of Building Wealth

I did these 10 side hustles while holding a full-time job, so I share them here so you can be inspired to grow your wealth through a side hustle that you enjoy.

I Did These 10 Side Hustles While Working Full Time | 10 Side Hustle Ideas To Help You Earn An Extra Income

Struggling with inflation and high cost of living? Try these 10 methods to help you save money and accumulate more savings for investments or rainy days.

10 Ways To Save Money To Help You Fight Inflation & Rising Costs Of Living

Why I am building $120,000 of cash reserves in Singapore Savings Bonds (SSB) & 5 reasons why I think SSB is a worthy low or zero-risk investment that you can consider.

Why I Am Building $120,000 Of Cash Reserves In Singapore Savings Bonds (SSB)? | 5 Reasons Why SSB Is A Worthy Low-Risk Investment

Sharing why I am doing Dollar Cost Average (DCA) into SPY and QQQ ETF for long-term investments and a step-by-step guide to doing it automatically with Interactive Brokers.

Why I Am Doing DCA (Automatically) For SPY & QQQ For My Long Term Investment? (20% ~ 30% Upside Potential) | Step By Step Guide To Activating Automatic Recurring Investment On IBKR

Can options trading provide you with extra sideline income every month? In this post, I share my experience of generating income from options trading over the last 3 years.

Options Trading For Passive Income: Truth Or Myth?