I used to own 300 shares of Nvidia back in 2023 but I sold Covered CALL on them at the worst possible time when Nvidia had reached its bottom at $100+ in early 2023. My breakeven price was around USD263, and my strike price was around USD200 but the premium was not high as Nvidia was trading at a much lower price than the SP.

Then, Nvidia’s share price started to moon and the premium of the Covered CALL contract increased exponentially. It seemed impossible to buy back the contract as the premium was 10x the premium I received for selling the Covered CALL.

So, I was caught in this situation where the share price rose rapidly but I could not take the profits because while I had a paper gain on the share price, to realize it would mean I had to take the loss on my Nvidia options contract.

Read more here:

How A Wrong Move In Options Trading Stopped Me From Taking $66k Profit | Disadvantages (Risks) Of Selling Covered CALL Options

Then I made the worst decision of my options trading journey thus far by selling away 200 of my 300 Nvidia shares to redeem the capital and going into selling naked CALL because I thought that Nvidia was due for a correction after its Q2 result and that I could mitigate the risk of early assignment rolling the CALL options to a later date until a market crash, which would help me recover and close the options contracts.

Read more here:

Nvidia Catch-22: How I Attempt To Unwrong A Failed Covered CALL Trade

Nvidia has since doubled and rose from 400+ to its all-time high of USD 974. Each options contract is worth USD 71k, which is 35 times the premium that I received in the first place.

As I am 200 shares short for Nvidia, my unrealised loss amounts to USD 141.5k when Nvidia was trading at USD 875. If Nvidia is going to hit USD 1k or more in the future, this unrealised loss would be even greater. In short, the potential loss is unlimited when the trend works against you.

Initially, my plan was to let the contract remain as they were (even when unrealized losses were increasing) until I had a chance to get out in the very distant future, which means I will keep rolling the contract to a later expiration date and increasing the SP each time. This becomes an infinite get-out-of-jail card until two scenarios happen: Nvidia crashes when supply overtakes demand (like in 2022) so I can close the contract or when I finally buy enough Nvidia shares to cover my short positions. These two scenarios can only happen if there is no early assignment of the option contract due to the buyer exercising his rights to buy the shares.

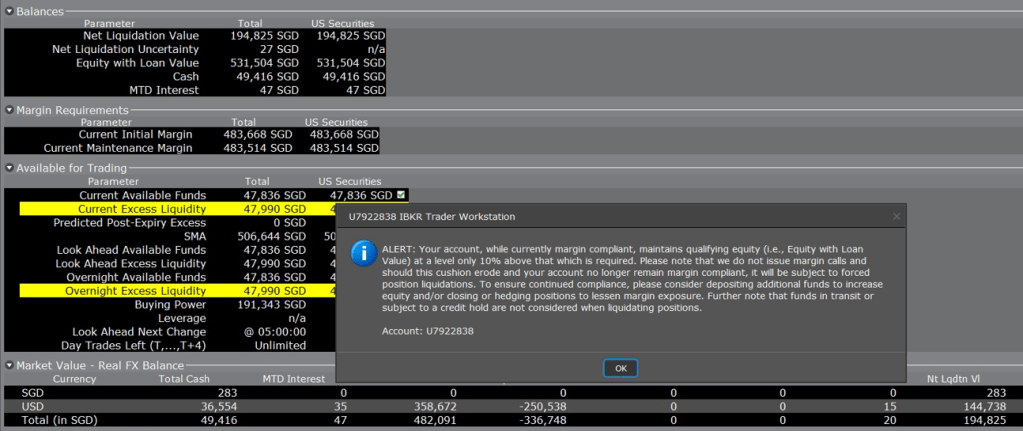

However, I started to face liquidity warnings because the rapid rise in Nvidia’s share price was increasing my maintenance margin and eating away my excess liquidity. It does not help that the share price of Tesla, the biggest position in my portfolio, kept dropping which further lowered my liquidity value.

Read more about my liquidation warning:

Getting Liquidation Warning | Why I am Getting Liquidation Warning & What You Can Do If You Get Liquidation Warning

Concluding Thoughts

I hope this experience is useful to you especially if you are considering short-selling some stocks that you think are going to crash or selling naked CALL hoping to redeem them later at a lower premium. If the stock goes against you for whatever reasons, for example, in the case of Nvidia where it becomes the frontrunner in a totally new (AI) revolution, then you will face unlimited losses if you need to redeem back your options contract or shares. So, manage your risk and plan for the worst-case scenario of every decision you make in trading or investing. If you are really bearish on a stock, then buying a PUT option would be a safer choice.

*** EARN FREE NVIDIA SHARES ***

Sign up for WeBull Securities Brokerage and sure-win free Nvidia shares:

Receive Free Money When You Sign Up With WeBull Securities Platform

*** FREE BEGINNER GUIDE TO OPTIONS TRADING ***

Keen to learn about options trading but do not wish to pay for expensive courses, this newbie guide will help gain the knowledge and fundamentals to understand options better. And it’s totally free!

The Newbie’s Guide To Options Trading

*** FREE MOTIVATIONAL BOOK ***

If earning more money from your investment does not excite you anymore, you may be seeking a purpose that brings fulfillment and meaning in life. I have written a motivational book that may be useful to you in some ways. You can also download a free copy here:

https://learninginvestmentwithjasoncai.com/finding-the-magical-realm-of-happiness-motivational-book

*** FOLLOW US ON SOCIAL MEDIA ***

Follow me on Facebook, LinkedIn, to get notified of my latest posts on social media. Or subscribe to my blog (scroll to the bottom of the page) to have my new posts sent directly to your mailbox.

*** BUY ME A CUP OF COFFEE ***

If my blog has benefited you in some ways and you would like to offer a token of appreciation, you may do so via this page. Thank you very much for your support!

*** MUST-READ BLOG POSTS ***

After accumulating more than 600k of unrealized losses on my portfolio, I wrote this article to encourage friends and investors who are also losing a lot of money to the market.

If You Are Feeling Depressed From Losing Lots Of Money In The Stock Market, Here’s An Article For You

In the 10 years of my investing journey, I have made many mistakes but also learned many lessons from these mistakes. I compiled the 10 most valuable lessons that I have learned and may they help you succeed in your investing journey.

Happy 10 Years Of Investing | 348k (Realised) Profit, 635k (Unrealized) Loss & 10 Lessons Learnt

The precious 6 lessons I learnt after cutting more than half a million of losses in the stock market through bad investments and risky trades.

6 Lessons Learnt After Losing 551k In 10 Years Of Investing & Options Trading | What Newbies Should Know They Start Investing/ Trading

How I managed to build a 1M investment/ trading portfolio despite coming from humble beginnings.

How A Poor Kid Got To A 1M Investment Portfolio | Tips & Principles Of Building Wealth

I did these 10 side hustles while holding a full-time job, so I share them here so you can be inspired to grow your wealth through a side hustle that you enjoy.

I Did These 10 Side Hustles While Working Full Time | 10 Side Hustle Ideas To Help You Earn An Extra Income

Struggling with inflation and high cost of living? Try these 10 methods to help you save money and accumulate more savings for investments or rainy days.

10 Ways To Save Money To Help You Fight Inflation & Rising Costs Of Living

Why I am building $120,000 of cash reserves in Singapore Savings Bonds (SSB) & 5 reasons why I think SSB is a worthy low or zero-risk investment that you can consider.

Why I Am Building $120,000 Of Cash Reserves In Singapore Savings Bonds (SSB)? | 5 Reasons Why SSB Is A Worthy Low-Risk Investment

Sharing why I am doing Dollar Cost Average (DCA) into SPY and QQQ ETF for long-term investments and a step-by-step guide to doing it automatically with Interactive Brokers.

Why I Am Doing DCA (Automatically) For SPY & QQQ For My Long Term Investment? (20% ~ 30% Upside Potential) | Step By Step Guide To Activating Automatic Recurring Investment On IBKR

Can options trading provide you with extra sideline income every month? In this post, I share my experience of generating income from options trading over the last 3 years.

Options Trading For Passive Income: Truth Or Myth?

Why did you sell 2026 call?

LikeLike

Hi Voka, because I wanted to roll it to a later date for a higher SP (so that I can eventually sell higher each time with each rolling) and to avoid early assignment because there is much extrinsic (time) value left in the contract.

LikeLike

got it, thanks – helpful for this option newbie.

LikeLike

Hi Voka, please don’t mention it, I am happy to help if I can, cheers 😊

LikeLike

uh sorry I dont get your post. can I ask why didnt you just let the shares be assigned if they were ITM? you could have earned a small amount of money instead of going through all these right

LikeLike

My SP back then when I had those 3 Covered CALL contracts was lower than my average price. Assume that the shares get assigned, I would have made a loss selling 300 shares at that strike price. However, trying to close the options contract is also bad because premium has 10x since I sold. So, it is a double whammy situation back then.

I shared the background in this post:

LikeLike