Financial Independence Retire Early aka the FIRE movement seems to be the Holy Grail of investing, especially for the young working adults who do not wish to slog their whole life at work, only to be left with limited time when they finally retired at 65 years (or older).

Why do I think that FIRE is not suitable for everyone?

The reason has nothing to do with finances because most people who are pursuing FIRE have got this angle well-covered. They are able to achieve an ample supply of funds to see through their long retirement years ahead.

Let’s do a hypothesis and assume you have reached your goal of financial freedom and you can now retire early.

Then, what comes next?

Finally, no need to rush to work or turn on the computer every morning, no more deadlines, no more mean bosses, demanding customers, or toxic colleagues.

You can sleep as late as you want, go travel, do volunteer work, read a book by the beach or simply binge-watch your movies and dramas. The dream life has begun.

But what happens when the novelty wears off?

And this dream life becomes boring for you?

Where is the motivation to get up and have a productive day going to come from?

Now, there is no more stress of reporting to the office on time, meeting your KPI at work, rushing deadlines, or even wanting to earn more money for your retirement. You have achieved them all and there is no more drive to accomplish anything further in this aspect.

Then, another challenge will appear.

How to live your life meaningfully until it ends?

It is torturous living life aimlessly with nothing to keep you excited. Life with no stress and struggles at all is like a butterfly with her shell cut open for her while she tries to break free of it. The butterfly will remain weak until she dies.

So, for retirement or early retirement to be fulfilling, it is important to start planning ahead. Most people know about the financial planning part and they can assemble millions for that.

But what about other aspects?

What are the things that will keep you busy, excited, and happy not just for the short term but also possibly sustain your interest and passion for the long term?

Look beyond the weeks and months and start planning for the years ahead. Our life expectancy gets higher with advancements in biosciences and technology. It means we have more years needing something to make us FEEL alive.

Don’t wait till retirement or financial freedom comes then start to think about what you really want to do. Start thinking and planning now. Or even better, start now with baby steps towards what you want to do eventually.

Here are some possible ideas that you can consider.

Let’s say you have always wanted to enrich the lives of underprivileged children living in rental estates and wish they can have a more memorable childhood. Maybe you would like to pick up baking as a hobby so you can bake free birthday cakes for them? Or pick up balloon sculpturing as a skill? You can check out volunteer groups on what they do and how they reach out to needy families and slowly be a part and touch more lives together.

If you have been passionate about saving the Earth, maybe you can start a blog to talk about climate change, deforestation, global warming, and ways of slowing down the damage. You can reach out to the schools, youth, and students to inspire a whole new generation of world change agents who would be more kind to Mother Nature.

There are so many more tips and ideas that you can explore to enrich your life and the lives of others, for now, and for the future when you no longer need to work for money.

It’s All About Finding A Purpose

Maybe your work now is tiring, stressful, unmotivating and you feel like you are chained to your job but somehow it has provided you with a sense of purpose in life, because through your salary, you have managed to achieve a better quality of life with your loved ones and enjoy the simple pleasures that money can buy.

There may not be any meaning or real purpose in the work you do but there is definitely meaning in working itself. Thus, when you stop working, you will need to find another purpose, the one that has kept you going for years because you no longer need the money now.

Health

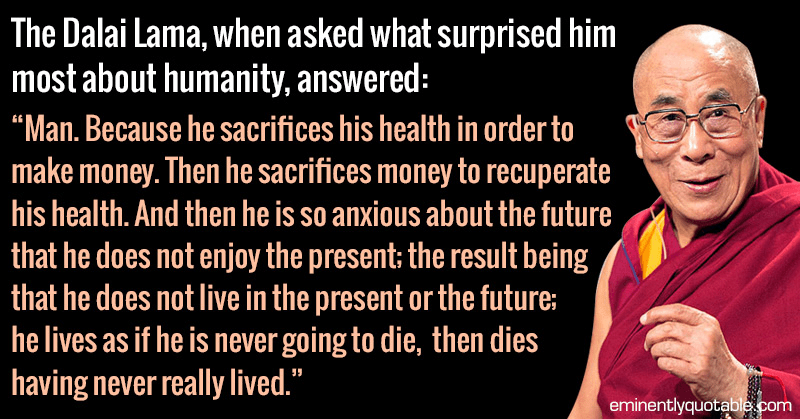

Some people took on more jobs, more side hustles just to make sure they can reach financial independence earlier, without realising that they are stretching their health to the limits and on the verge of breaking point.

When health is compromised, there is no meaning behind achieving financial freedom anymore, because without health, you basically can’t enjoy anything in life. The worst outcome is to spend all your wealth to try to nurse back your health.

Ikigai

Other chasing the FIRE movement, another concept that we can explore is Ikigai.

Ikigai is a Japanese concept that means your ‘reason for being.’ ‘Iki’ in Japanese means ‘life,’ and ‘gai’ describes value or worth. Your ikigai is finding your life purpose or your bliss. It is a amazing subset of 4 factors that can help you find joy and fulfillment in life and they are, “What you love to do?”, “What you are good at?”, “What the world needs?” and “What you get paid for?”.

Let me give an example of Ikigai.

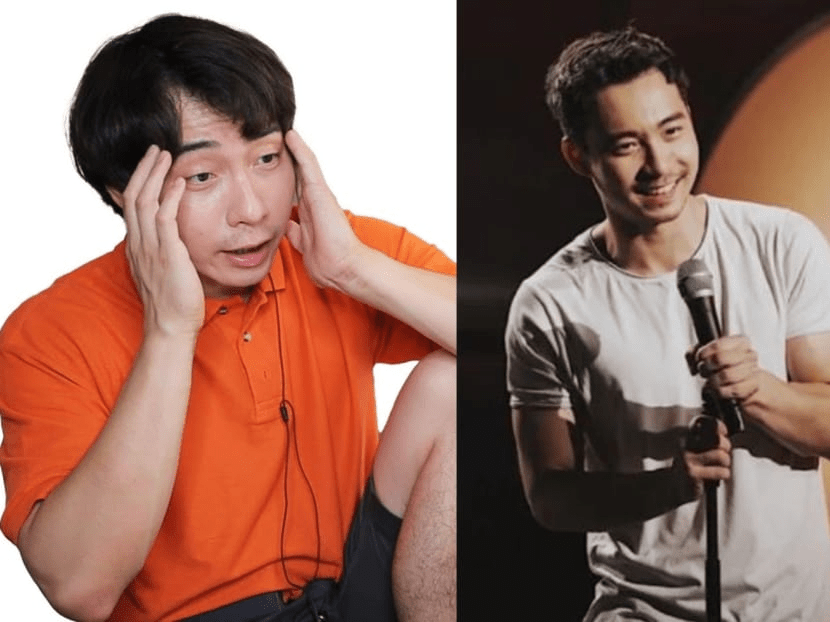

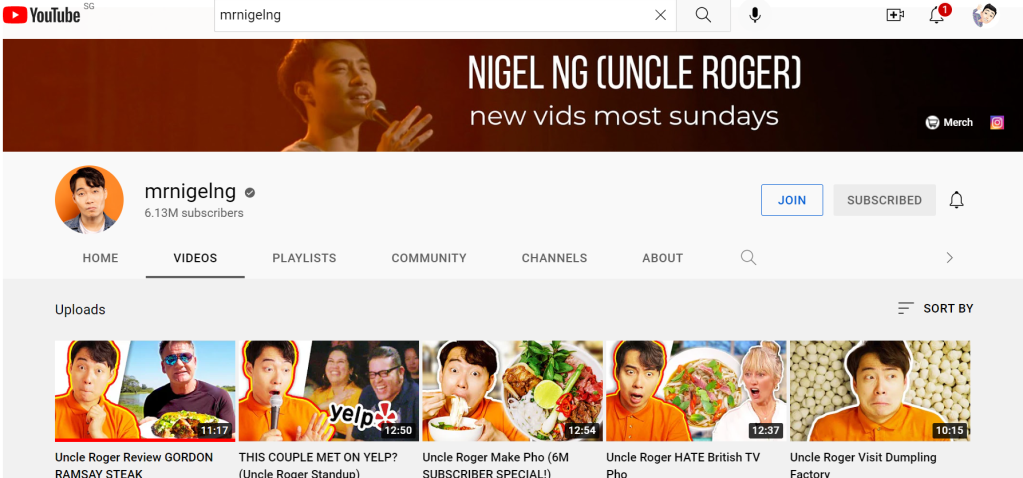

Mr Nigel is a standup comedian who is the creater behind the very famous online persona called Uncle Roger, who mainly critiques cooking videos on his YouTube channel, which has gartnered more than 6M subscribers.

So Mr Nigel loves making people laugh, he is good at it too as seen from the immense popularity of the Uncle Roger character, the world needs more laughter and entertainment after the never-ending battle with the pandemic and he gets paid really well by YouTube for his content.

Achieving Ikigai may not seem easy but it is worthwhile to work in this direction. It may not need to run parallel with the FIRE movement as it can also complement the FIRE movement, providing a sense of purpose in the things you do during your retirement and also getting paid for it.

Concluding Thoughts

The purpose of this article is not discourage anyone from the FIRE movement, but rather to get you prepared for the FIRE movement if you are pursuing it. Many people focus too much on the FI (financial independence) but neglect the second part of RE (retire early) on what they wish to do for the long retirement years ahead. I hope this article provides some food for thought for you and you can start to plan for what you really want to do when you finally retire early.

Lasly, Life is not about chasing milestone after milestone. It is the process that makes up the days and whether we enjoy it that makes everything worthwhile. In pursuit of financial freedom, don’t forget about the things that truly matter and to enjoy the process. I wish you all the best in your journey towards achieving your dreams and goals.

*** SEE MY TRADES & PORTFOLIO ON PATREON ***

If you are interested to find out more about my options trades and investment portfolio, I will be updating them on Patreon (on the same day I made the trades), so do follow me there if you need some reference or inspiration.

*** EARN FREE MONEY ***

Sign up for WeBull Securities Brokerage and sure-win free shares:

Receive Free Money When You Sign Up With WeBull Securities Platform

*** FREE BEGINNER GUIDE TO OPTIONS TRADING ***

Keen to learn about options trading but do not wish to pay for expensive courses, this newbie guide will help gain the knowledge and fundamentals to understand options better. And it’s totally free!

The Newbie’s Guide To Options Trading

*** FREE MOTIVATIONAL BOOK ***

If earning more money from your investment does not excite you anymore, you may be seeking a purpose that brings fulfillment and meaning in life. I have written a motivational book that may be useful to you in some ways. You can also download a free copy here:

https://learninginvestmentwithjasoncai.com/finding-the-magical-realm-of-happiness-motivational-book

*** FOLLOW US ON SOCIAL MEDIA ***

Follow me on Facebook, LinkedIn, to get notified of my latest posts on social media. Or subscribe to my blog (scroll to the bottom of the page) to have my new posts sent directly to your mailbox.

*** BUY ME A CUP OF COFFEE ***

If my blog has benefited you in some ways and you would like to offer a token of appreciation, you may do so via this page. Thank you very much for your support!

*** MUST-READ BLOG POSTS ***

After accumulating more than 600k of unrealized losses on my portfolio, I wrote this article to encourage friends and investors who are also losing a lot of money to the market.

If You Are Feeling Depressed From Losing Lots Of Money In The Stock Market, Here’s An Article For You

In the 10 years of my investing journey, I have made many mistakes but also learned many lessons from these mistakes. I compiled the 10 most valuable lessons that I have learned and may they help you succeed in your investing journey.

Happy 10 Years Of Investing | 348k (Realised) Profit, 635k (Unrealized) Loss & 10 Lessons Learnt

The precious 6 lessons I learnt after cutting more than half a million of losses in the stock market through bad investments and risky trades.

6 Lessons Learnt After Losing 551k In 10 Years Of Investing & Options Trading | What Newbies Should Know They Start Investing/ Trading

How I managed to build a 1M investment/ trading portfolio despite coming from humble beginnings.

How A Poor Kid Got To A 1M Investment Portfolio | Tips & Principles Of Building Wealth

I did these 10 side hustles while holding a full-time job, so I share them here so you can be inspired to grow your wealth through a side hustle that you enjoy.

I Did These 10 Side Hustles While Working Full Time | 10 Side Hustle Ideas To Help You Earn An Extra Income

Struggling with inflation and high cost of living? Try these 10 methods to help you save money and accumulate more savings for investments or rainy days.

10 Ways To Save Money To Help You Fight Inflation & Rising Costs Of Living

Why I am building $120,000 of cash reserves in Singapore Savings Bonds (SSB) & 5 reasons why I think SSB is a worthy low or zero-risk investment that you can consider.

Why I Am Building $120,000 Of Cash Reserves In Singapore Savings Bonds (SSB)? | 5 Reasons Why SSB Is A Worthy Low-Risk Investment

Sharing why I am doing Dollar Cost Average (DCA) into SPY and QQQ ETF for long-term investments and a step-by-step guide to doing it automatically with Interactive Brokers.

Why I Am Doing DCA (Automatically) For SPY & QQQ For My Long Term Investment? (20% ~ 30% Upside Potential) | Step By Step Guide To Activating Automatic Recurring Investment On IBKR

Can options trading provide you with extra sideline income every month? In this post, I share my experience of generating income from options trading over the last 3 years.

Options Trading For Passive Income: Truth Or Myth?