When I first started my full-time job 15 years ago, my MIL gave me a very good piece of advice. She asked me to go upgrade my health insurance (hospitalisation plan) to the maximum coverage and her reasons were simple: I was better afford the increase in premium as I had started working and it was better to get maximum coverage while I was still fit and healthy. Otherwise, the insurance company may exclude the pre-existing illness in the coverage or demand a higher premium to get a pre-existing condition covered.

At 25, fresh out of Uni and entering the adult working world, the thought of being hospitalized had never crossed my mind but I followed her advice anyway as the premium was still affordable to me.

I upgraded my health insurance to a maximum coverage of 90%, where I would pay 10% of the bill, which was further capped at $3,000. The health insurance covers hospitalisation stay at private hospitals or admission as private patients in government hospitals where I get to choose the doctors I want. The outpatient bills that was incurred 90 days before and after the hospitalisation were also covered.

In another policy, I also had hospitalisation benefits, which paid me $200 for every day stayed in hospital and $100 for every day of hospitalisation leave.

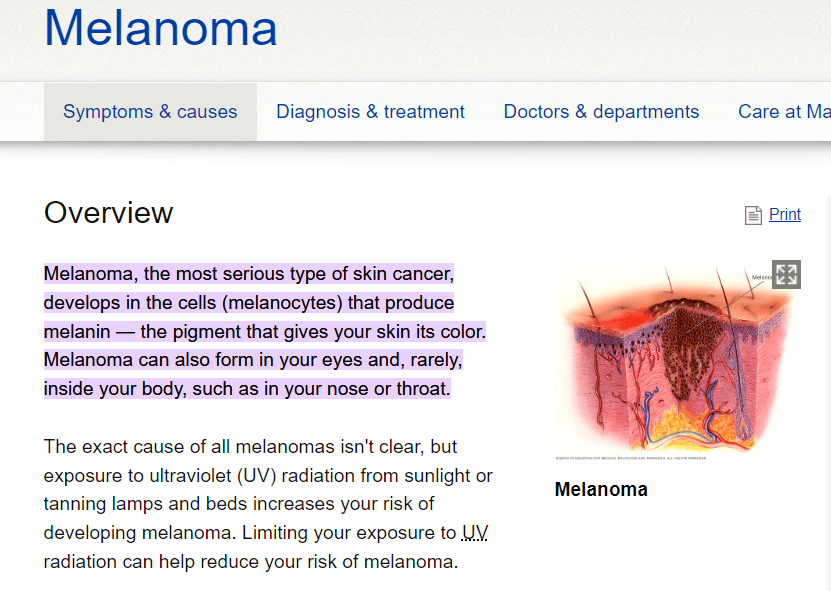

Fast forward 6 years to where I was 31, things started to go wrong for my health. A biopsy done at National Skin Center (NSC) confirmed that I had Melanoma (skin cancer). Thankfully, it was at an early stage. However, it was still a shock as no one in my family tree, from grandparents to cousins, for both sides of my parents, ever had been diagnosed with cancer before. It was also uncommon for my health profile of being a non-smoker, non-drinker, young Asian male to get Melanoma but I got it nevertheless.

The next few weeks were filled with anxiety and uncertainties as my family and I scrambled for the right treatment protocol for this condition that we knew so little about. The recommendation from National Skin Center was for me to do surgery at Tan Tock Seng Hospital (TTSH) because they (NSC and TTSH) were under the National Healthcare Group and that records could be exchanged.

However, as I was under the subsidised track, I would need to wait for a couple of months to see the bone specialist and possibly wait another few months before I could do the surgery to treat my condition, as the schedule at the hospital for subsidised patients was fully packed.

My family and I then went to National Cancer Center to book a Senior Consultant (Dr. Yong) to seek a second opinion. Dr. Yong referred us to a colleague, who was the Head of Hand Surgery at Singapore General Hospital (SGH), Dr. Andrew Chin, to look at my case. When we met Dr. Andrew, he told us that he could do the surgery in about 2 weeks. That was much faster than having to wait for more than 4 months, which by then, my cancer would have progressed to a later and more aggressive stage.

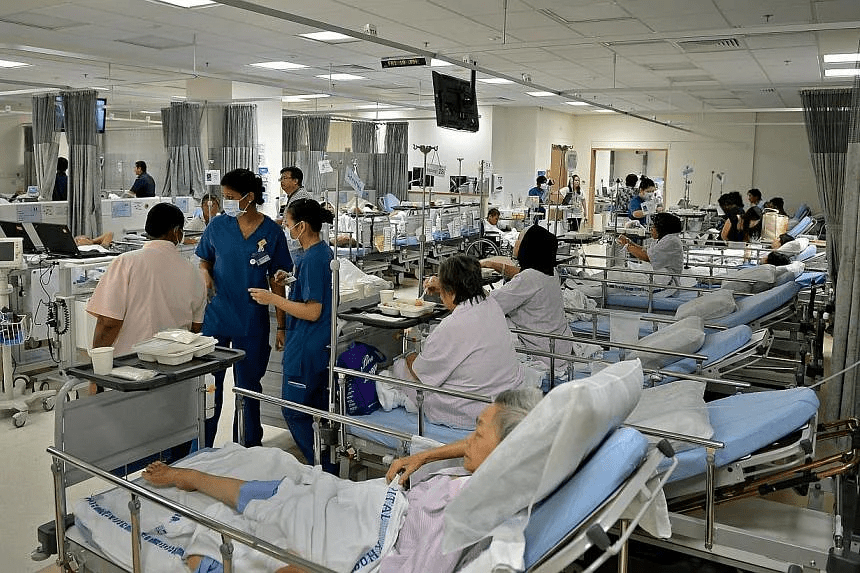

I was admitted to SGH as a private patient and did the surgery. It was a 4-hour long surgery that involved the complete removal of my nail bed and skin grafting was also done to replace the skin that was removed.

The surgery cost around $7,000 and I paid 10% with Medisave and did not fork out any cash. The bills incurred seeing all the senior consultant doctors before the surgery and follow-up checks after the surgery were also 100% covered under my health insurance. I paid those bills upfront and claimed them from my insurance company afterward. The doctor gave me 14 days of MC which I claimed $1,400 hospitalisation benefits.

So, for this incident, not only did I not pay a huge sum upfront to get treatment fast, I actually gained some cash out of it, because I was well-covered by my health insurance. This goes to show the importance of having adequate cover as it could mean a difference between life and death if the illness was not properly treated in time and instead allowed to worsen due to a long waiting time for treatment. Furthermore, I get to choose the best doctors available to increase the chance of success for the surgery.

The story does not end here though.

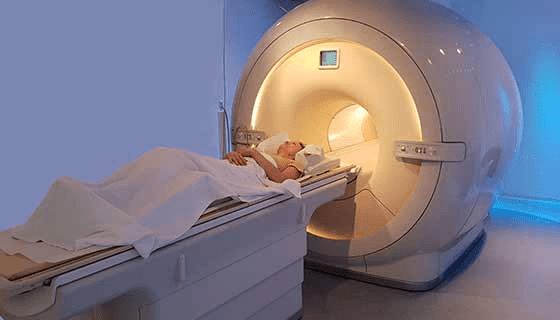

My oncologist at National Cancer Center ordered a CT scan to make sure there is no cancer cells staying dormant in other parts of the body or organ. He was kind enough to admit me for one day in hospital so that I could make an insurance claim. The CT scan cost around $2,000 and I again claimed up to 90% of the bill and the pre and post hospitlalisation consultation as well as the cash benefits for the hospitalisation leave.

6 months later after my first surgery, I suffered a complication on my operation site and my lymph nodes was infected. I was put on strong IV drip that did not helped, so I went through 2 further surgeries to fix the infection. I stayed in Class A ward during this period and claimed the cash benefits of the hospitalisation stay and subsequent hospitalisation leave. The treatment cost was higher this time round compared to my previous surgery as there were two surgeries being done and I stayed in the hospital for 4 days.

I had a few more surgeries over the years to fix any adnormal growths which later turned out to be non-cancerous after lab tests. For each surgery, I was able to have the bills covered or at least reduced to an affordable amount for myself. I was able to pick the surgeon whom I have confidence in and get the surgery done in the shortest time as a private patient. I was able to rest in the comfort of my own room because it was all part of the plan. Furthermore, I was able to claim hospitalisation cash benefits on the hospitalisation stay or leave. I also had 2 further nasal endoscopy tests done which cost a few hundred dollars each. The total amount of claim I got from my insurance policies for my surgeries and scopes has exceeded $30,000.

Concluding Thoughts

I hope to highlight the importance of getting yourself adequately covered by insurance through this article. When I had totally no idea the importance of having the maximum coverage, I was enlightened and thus, I hope this sharing can help someone too.

When we are strong and healthy, we may think that insurance policies are a waste of money. However, when our health starts to deteriorate, whether it is with age or some unknown and unforseen factors, then insurance starts to show its true worth. It is better to be prepared than to get caught offguard by a hefty medical bill.

I am not suggesting that everyone should get maximum 100% coverage with hospitalisation cash benefits because all these comes at a cost of a higher premium paid every month. So, you have to weigh off the pros and cons of higher coverage, more comfortable recuperating environment versus the budget that you can spend on paying the premium.

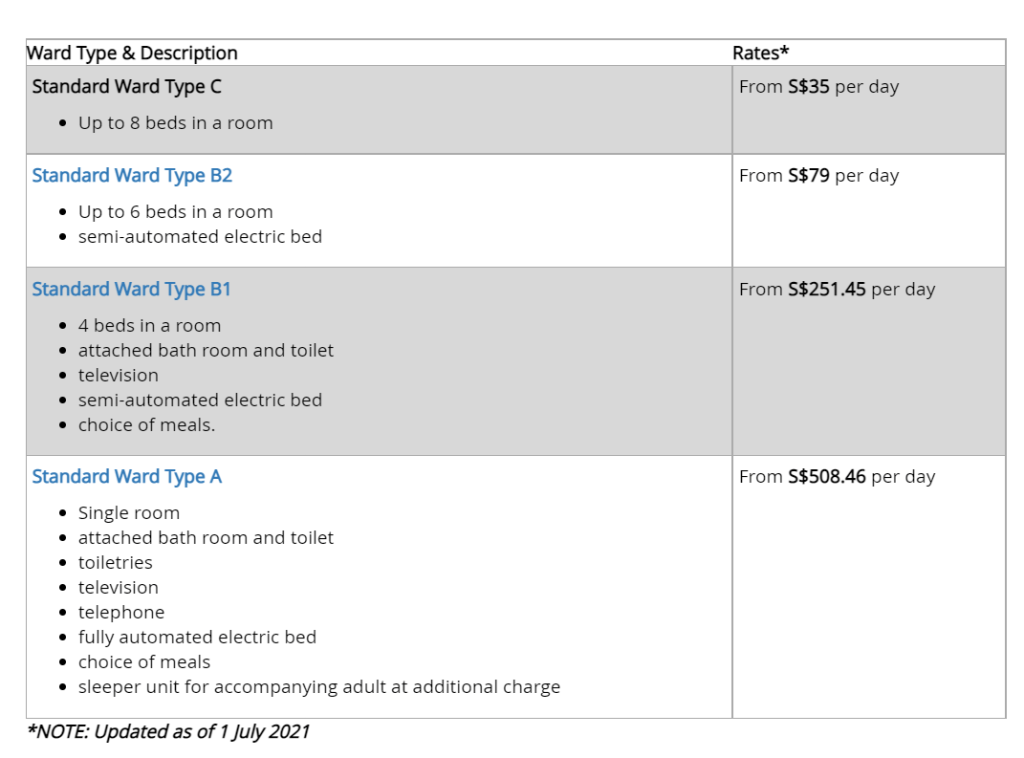

Singaporeans and PRs are by default covered under Medishield Life but it would mean recuperating in the same room with 5 or 7 other patients, sharing a communal toilet and not having aircon or TV and not being able to choose doctors. The hospitalisation bills are not fully covered as well.

This is the SGH room rates and facilities available in each ward class.

Lastly, building wealth is not just about earning more money through smart investments, career progression or entrepreneurship. It is also about cultivating good money habits such as knowing how to save money so that you do not overspend what you have painstakingly earned. It is preparing for contingency events such as retrenchment or the onset of a major illness that could wipe out all your life savings.

Have you been upskilling yourself to make yourself valuable and marketable so that in the unfortunate event that you lose your job, you are able to find a replacement job quickly? Or do you have more than one source of income that can help you tide through the difficult times if you should lose your main source of income? Are you well-covered with insurance so you do not have to worry about hefty bills or long waiting time to get treated? If you have not thought through these questions and scenarios, it is not too late to start planning now.

*** SEE MY TRADES & PORTFOLIO ON PATREON ***

If you are interested to find out more about my options trades and investment portfolio, I will be updating them on Patreon (on the same day I made the trades), so do follow me there if you need some reference or inspiration.

*** EARN FREE MONEY ***

Sign up for WeBull Securities Brokerage and sure-win free shares:

Receive Free Money When You Sign Up With WeBull Securities Platform

*** FREE BEGINNER GUIDE TO OPTIONS TRADING ***

Keen to learn about options trading but do not wish to pay for expensive courses, this newbie guide will help gain the knowledge and fundamentals to understand options better. And it’s totally free!

The Newbie’s Guide To Options Trading

*** FREE MOTIVATIONAL BOOK ***

If earning more money from your investment does not excite you anymore, you may be seeking a purpose that brings fulfillment and meaning in life. I have written a motivational book that may be useful to you in some ways. You can also download a free copy here:

https://learninginvestmentwithjasoncai.com/finding-the-magical-realm-of-happiness-motivational-book

*** FOLLOW US ON SOCIAL MEDIA ***

Follow me on Facebook, LinkedIn, to get notified of my latest posts on social media. Or subscribe to my blog (scroll to the bottom of the page) to have my new posts sent directly to your mailbox.

*** BUY ME A CUP OF COFFEE ***

If my blog has benefited you in some ways and you would like to offer a token of appreciation, you may do so via this page. Thank you very much for your support!

*** MUST-READ BLOG POSTS ***

After accumulating more than 600k of unrealized losses on my portfolio, I wrote this article to encourage friends and investors who are also losing a lot of money to the market.

If You Are Feeling Depressed From Losing Lots Of Money In The Stock Market, Here’s An Article For You

In the 10 years of my investing journey, I have made many mistakes but also learned many lessons from these mistakes. I compiled the 10 most valuable lessons that I have learned and may they help you succeed in your investing journey.

Happy 10 Years Of Investing | 348k (Realised) Profit, 635k (Unrealized) Loss & 10 Lessons Learnt

The precious 6 lessons I learnt after cutting more than half a million of losses in the stock market through bad investments and risky trades.

6 Lessons Learnt After Losing 551k In 10 Years Of Investing & Options Trading | What Newbies Should Know They Start Investing/ Trading

How I managed to build a 1M investment/ trading portfolio despite coming from humble beginnings.

How A Poor Kid Got To A 1M Investment Portfolio | Tips & Principles Of Building Wealth

I did these 10 side hustles while holding a full-time job, so I share them here so you can be inspired to grow your wealth through a side hustle that you enjoy.

I Did These 10 Side Hustles While Working Full Time | 10 Side Hustle Ideas To Help You Earn An Extra Income

Struggling with inflation and high cost of living? Try these 10 methods to help you save money and accumulate more savings for investments or rainy days.

10 Ways To Save Money To Help You Fight Inflation & Rising Costs Of Living

Why I am building $120,000 of cash reserves in Singapore Savings Bonds (SSB) & 5 reasons why I think SSB is a worthy low or zero-risk investment that you can consider.

Why I Am Building $120,000 Of Cash Reserves In Singapore Savings Bonds (SSB)? | 5 Reasons Why SSB Is A Worthy Low-Risk Investment

Sharing why I am doing Dollar Cost Average (DCA) into SPY and QQQ ETF for long-term investments and a step-by-step guide to doing it automatically with Interactive Brokers.

Why I Am Doing DCA (Automatically) For SPY & QQQ For My Long Term Investment? (20% ~ 30% Upside Potential) | Step By Step Guide To Activating Automatic Recurring Investment On IBKR

Can options trading provide you with extra sideline income every month? In this post, I share my experience of generating income from options trading over the last 3 years.

Options Trading For Passive Income: Truth Or Myth?