One of my biggest mistakes in my investing journey was to sell and take profits on my SG bank stocks in 2022, in particular, DBS bank shares. I had accumulated them during the 2020 Covid crash, and my average price for DBS was around USD 20. That would have yielded more than a 10% return in annual dividends if I were still holding onto them today.

I Sold All Of My Bank Shares | The Final Step Towards Financial Freedom

Back then, I was chasing higher returns through options trading, and thus I sold my shares to free up the capital for my options trade. The profit alone was more than S$80k and with my original capital, I had a sizeable fund of more than S$200k for reinvesting. That move had not worked well as I eventually lost more than S$400k in options trading in 2022 alone.

I Closed All My Remaining LEAPS CALL Positions At A Total Loss of SGD415K (USD306K)

As part of my rebuilding plan following the catastrophic USD400k loss in February, I planned to create an investment portfolio consisting of three buckets: bonds (Singapore Savings Bond), dividend stocks, and growth stocks. This will help diversify the risk, as my capital will be divided into three different pools of assets with varying risk levels.

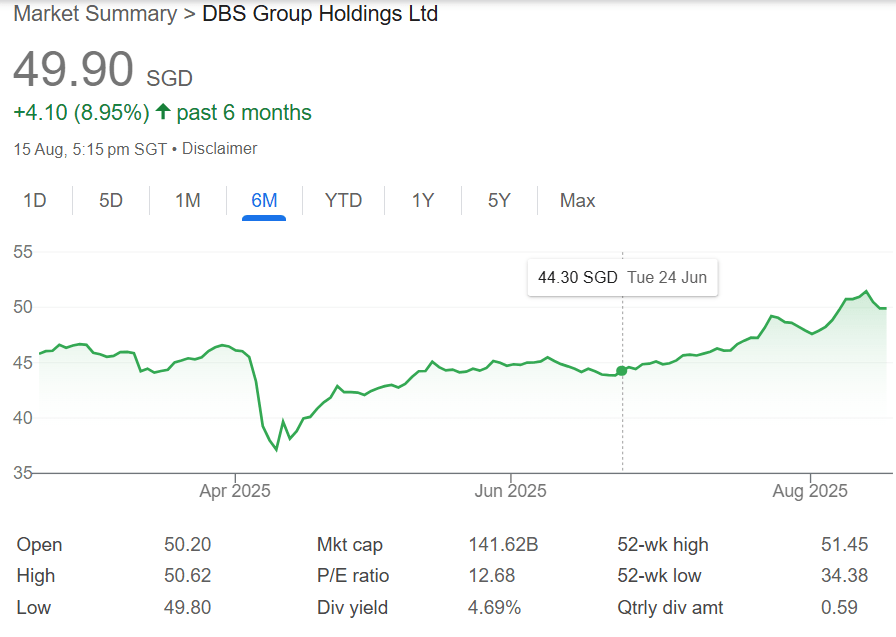

I bought 100 shares of DBS stock at S$44.11 on 24th June 2025 and another 100 shares of UOB at S$35.73 on 8th August 2025. The total capital invested is about S$8,000, with a dividend yield of around 5%.

I like dividend stocks for the passive income ability as it allows me to spend less time monitoring stock prices while the dividends come in every few months. The dividend yield, at around 5%, is also higher than the interest rate, around 2.5% to 3%, that SSB can offer. The share prices of these stocks (SG bank stocks) are usually generally quite stable, so I see them as an alternate store of wealth, that is only second to the ultra safe capital-guaranteed SSB. If the right stock is picked, e.g. DBS, shareholders enjoy capital gain as well. Since I bought DBS shares in June, I have gained about 13.1% in share price, with an upcoming 1.7% dividend payout happening this month (August 2025).

Concluding Thoughts

For my 3 buckets of asset classes, I have filled up the SSB bucket to S$150k, and I do not intend to add to it in the near future as SSB interest keeps dropping by the month. For my growth stock bucket that has the highest risk tolerance as I also use the capital for active trading, I have grown it from S$60k to S$73k since April 25. For my dividend bucket, I intend to grow it from the current S$8k to an eventual S$100k portfolio, which would yield a S$5k annual return or S$416 monthly return in passive income.

It is still a long way to go, but I believe I will get there someday. If you are keen to follow my journey and see how I rebuild after losing more than 1M of capital in my investing/ trading journey, do subscribe to my blog or follow me on my Patreon page for my updates on my daily trades.

** SEE MY TRADES & PORTFOLIO ON PATREON ***

If you are interested to find out more about my options trades and investment portfolio, I will be updating them on Patreon (on the same day I made the trades), so do follow me there if you need some reference or inspiration.

*** BUY ME A CUP OF COFFEE ***

If my blog has benefited you in some ways and you would like to offer a token of appreciation, you may do so via this page. Thank you very much for your support!

*** FINANCE BOOKS ***

If you are new to investing, options trading or personal finance and would like to get yourself educated about the fundamentals, you may want to consider these very popular and highly recommended books: One Up On Wall Street, The Psychology of Money, Rich Dad Poor Dad,

*** FREE BEGINNER GUIDE TO OPTIONS TRADING ***

Keen to learn about options trading but do not wish to pay for expensive courses, this newbie guide will help gain the knowledge and fundamentals to understand options better. And it’s totally free!

The Newbie’s Guide To Options Trading

*** FREE MOTIVATIONAL BOOK ***

If earning more money from your investment does not excite you anymore, you may be seeking a purpose that brings fulfillment and meaning in life. I have written a motivational book that may be useful to you in some ways. You can also download a free copy here:

https://learninginvestmentwithjasoncai.com/finding-the-magical-realm-of-happiness-motivational-book

*** FOLLOW US ON SOCIAL MEDIA ***

Follow me on Facebook, LinkedIn, to get notified of my latest posts on social media. Or subscribe to my blog (scroll to the bottom of the page) to have my new posts sent directly to your mailbox.

We also have a community passionate about investing, trading and personal finance over our Facebook group. So, join us there for a good discussion, post queries or share your financial knowledge.