My plan to max out the Singapore Savings Bond (SSB) limit of S$200k revolves around a couple of reasons; firstly is to have the cash reserves that I can tap on for contingency purpose and secondly, to have a very safe asset class for investment that can give me monthly passive income (target $500) using the SSB ladder method.

Further read here: First Step Towards Rebuilding My Portfolio: Target 200k SSB

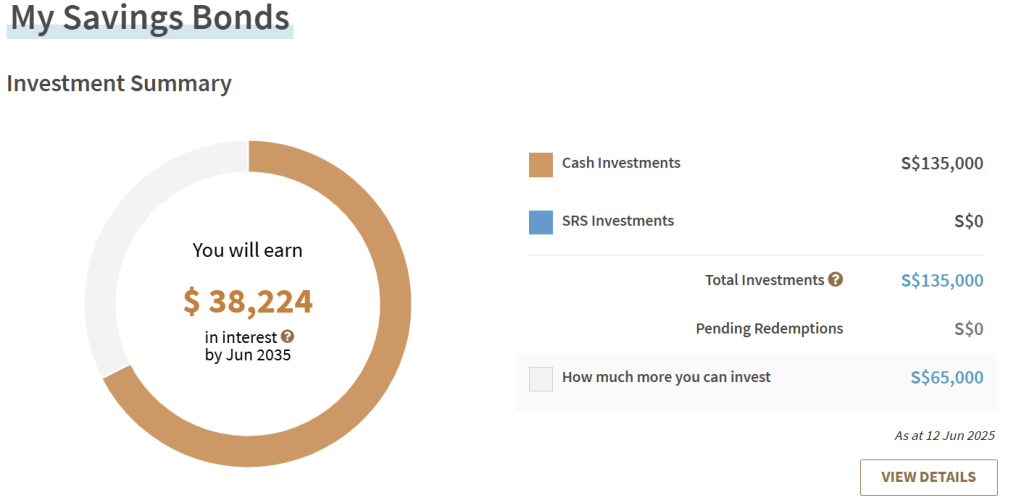

At this time of writing, I have completed the purchase of $135k worth of SSB.

The bond details are as follows:

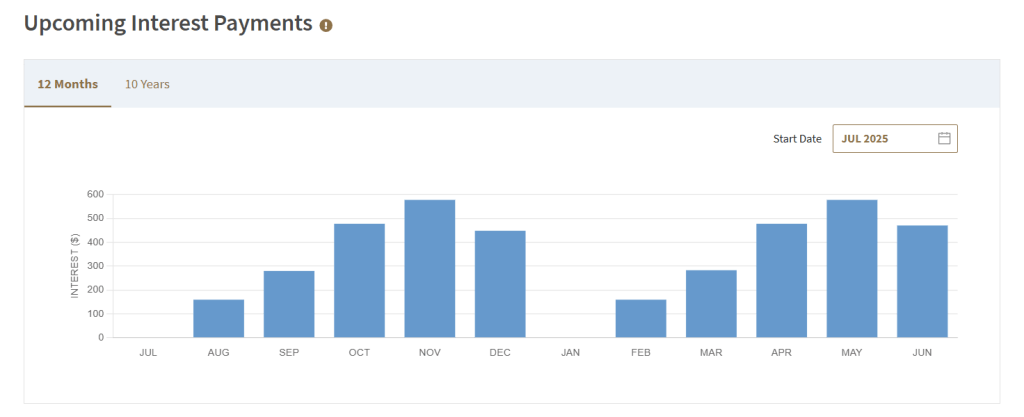

The monthly payout that I will be receiving is depicted in the graph below:

I will have payout every month except for January and July. My initial plan is to buy $35k worth of SSB for the month of July, $20k for Aug and $10k for Sept and that would add up to a total of $200k worth of SSB and have regular monthly payout of $400+ to $500+, over the next 10 years.

Changes to SSB Master Plan

As SSB 10 year average interest rate continues to fall,

March25 (2.97%) -> April25 (2.85%) -> June25 (2.56%) -> July25 (2.49%),

I am changing my plan to accumulate a total of $150k of SSB instead of the original plan of $200k. Therefore, the upcoming purchase of July25 SSB will be my last batch of purchase with $15k worth of bonds. After that is completed, I will still get a payout for every month for the entire year, However, some months will have a lower payout while some months will get a higher payout.

So, what will I do with the $50k that I set aside for SSB?

I will use it to purchase Singapore bank stocks, in particular DBS, over the next few months for the 5% dividend yield. I think the bank shares are fairly stable, though I am mentally prepared that there could be a huge correction during a bear market, which would lead to unrealised losses in my capital. However, that is the risk that I am willing to take for a higher dividend payout (double of SSB) and I am sure in the long run, maybe over 10 years, the share will go back to its All Time High (ATH) price.

So, this will be my likely payout for the coming months. After my last batch of purchase of SSB for July, I should get a range of $159 to $577 for my monthly payout, but some months will be supplement with dividend payout from my bank stocks.

Concluding Thoughts

The ultimate investment portfolio that I have envisaged consists of 3 buckets of funds; one in Singapore Savings Bonds ($150k), one in dividend stocks ($100k) and the last bucket is in growth stocks ($100k), which is likely to make up of US equities.

The last bucket of growth stock will also be used for the higher risk asset class, such as options trading. I have actually started on bucket 3 because the USD has dropped significantly against SDG in recent months and it is not worth converting my spare cash back to SGD. So, I started a USD45k investing + trading portfolio since April 25 and it has grown to USD48k at this time of writing.

Read more here: Update Of My USD45k Portfolio (Investing + Trading)

** SEE MY TRADES & PORTFOLIO ON PATREON ***

If you are interested to find out more about my options trades and investment portfolio, I will be updating them on Patreon (on the same day I made the trades), so do follow me there if you need some reference or inspiration.

*** BUY ME A CUP OF COFFEE ***

If my blog has benefited you in some ways and you would like to offer a token of appreciation, you may do so via this page. Thank you very much for your support!

*** FINANCE BOOKS ***

If you are new to investing, options trading or personal finance and would like to get yourself educated about the fundamentals, you may want to consider these very popular and highly recommended books: One Up On Wall Street, The Psychology of Money, Rich Dad Poor Dad,

*** FREE BEGINNER GUIDE TO OPTIONS TRADING ***

Keen to learn about options trading but do not wish to pay for expensive courses, this newbie guide will help gain the knowledge and fundamentals to understand options better. And it’s totally free!

The Newbie’s Guide To Options Trading

*** FREE MOTIVATIONAL BOOK ***

If earning more money from your investment does not excite you anymore, you may be seeking a purpose that brings fulfillment and meaning in life. I have written a motivational book that may be useful to you in some ways. You can also download a free copy here:

https://learninginvestmentwithjasoncai.com/finding-the-magical-realm-of-happiness-motivational-book

*** FOLLOW US ON SOCIAL MEDIA ***

Follow me on Facebook, LinkedIn, to get notified of my latest posts on social media. Or subscribe to my blog (scroll to the bottom of the page) to have my new posts sent directly to your mailbox.

We also have a community passionate about investing, trading and personal finance over our Facebook group. So, join us there for a good discussion, post queries or share your financial knowledge.