I chanced upon this very informative video on retirement planning, which is an interview conducted by a popular financial YouTuber, Kevin Learns Investing, and the CEO of Havand, Eddy Cheong, whose company helps clients with retirement planning, through personalized insurance solutions and advice, including guidance on maximizing CPF funds for retirement income.

The 37-minute video covers a wide range of topics such as CPF, insurance, investment, retirement income, annuity plan, budget, and more. Every topic is packed with plenty of nuggets of wisdom that I think can benefit you, especially if you have not started your retirement planning yet. If you have no time to watch the interview, the following pointers summarize the essence of each topic. There are also video timestamps for you to refer to if you need more information regarding a particular topic.

Key Considerations in Retirement Planning

- CPF (Central Provident Fund) offers stable and predictable growth:

- Returns of 2.5%–4% annually, unaffected by market conditions.

- Provides certainty in retirement planning, especially for those wary of market volatility.

- While CPF alone may suffice for a monthly income of $3,000 post-65, it might not support early retirement or higher payouts. Supplementary assets may be needed for those goals.

0:29 – Is it possible we don’t invest for retirement at all? Can we depend on CPF alone for retirement?

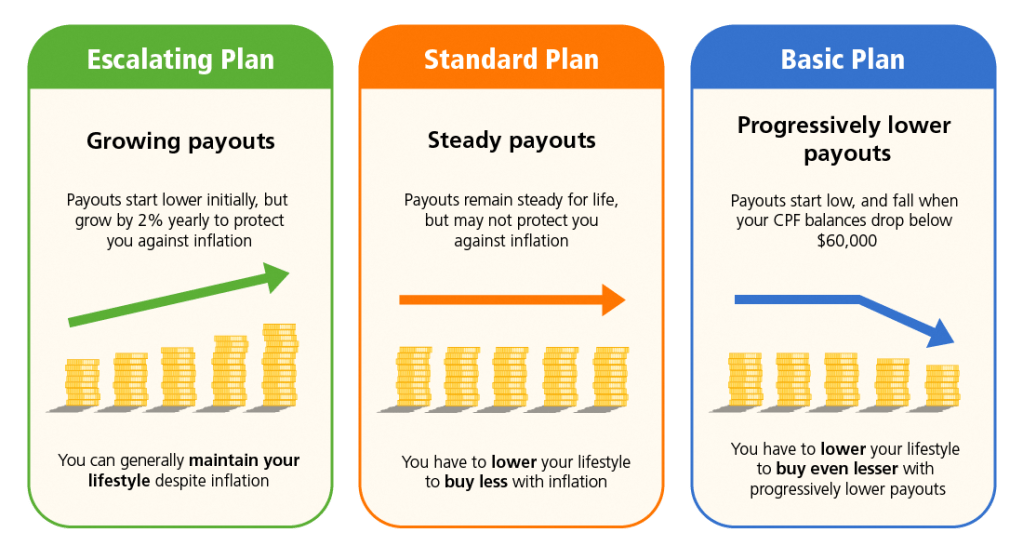

CPF Plans & Inflation

- Standard & Basic Plans offer fixed payouts for life but lack inflation adjustments.

- Escalating Plan increases payouts by 2% annually, helping to mitigate inflation’s effects over time. However, it starts with a lower initial payout.

2:06 – Is using CPF for retirement inflation-proof?

Key Retirement Risks to Address

- Inflation Risk:

- Rising costs mean the amount needed for retirement keeps increasing.

- Example: $1.5 million might cover a $5,000/month income for 25 years, but inflation amplifies this requirement.

- Longevity Risk:

- Singapore has one of the world’s longest life expectancies, averaging 81 years for men and 85 for women.

- Longer life expectancy means retirement funds must last beyond average lifespans—potentially increasing the amount required.

- Investment Risk:

- Market volatility affects investment value, making it critical to assess comfort with risks before choosing this approach.

- Healthcare Costs:

- Medical expenses and insurance premiums rise with age.

- Proper planning is essential to avoid depleting assets due to unexpected healthcare needs.

- Overspending Risk:

- Retirees may overspend initially (e.g., on travel), potentially exhausting funds prematurely.

Havend’s 3Cs Retirement Approach

- CPF Management:

- Maximize CPF contributions to leverage its risk-free, consistent returns.

- Cash Flow:

- Ensure reliable income streams to cover essential expenses (e.g., healthcare premiums) and discretionary spending.

- Coverage:

- Establish a medical safety net to protect assets during health crises.

3:04 – What does a secure retirement mean?

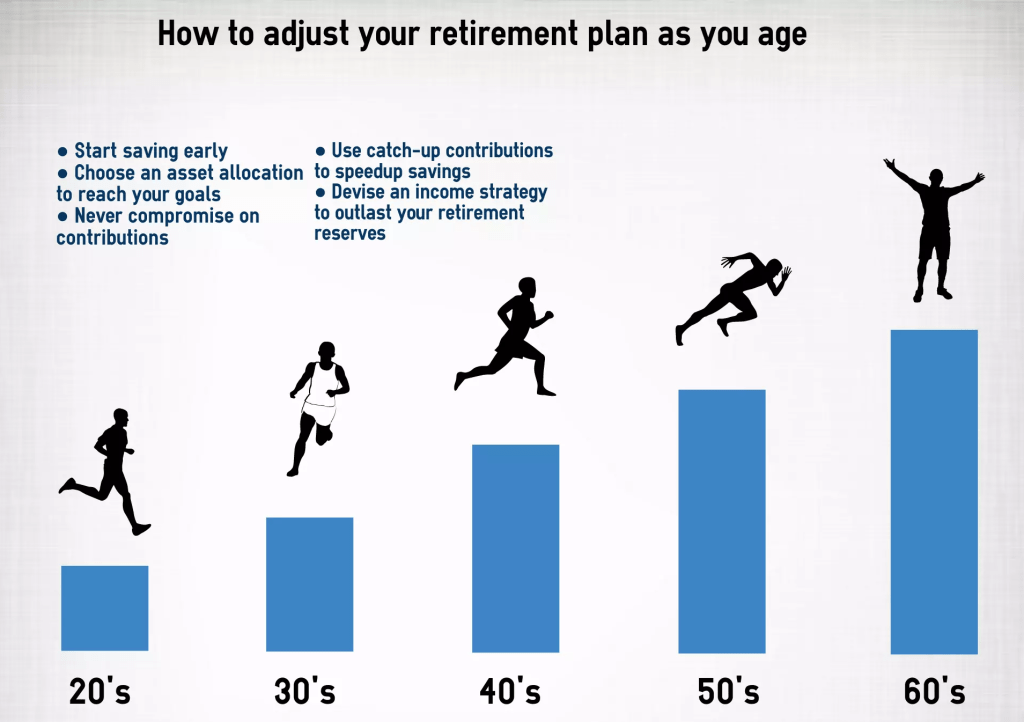

Budgeting for Retirement

- Allocation of funds depends on individual circumstances, such as financial resources, age, and commitments.

- General guideline: Set aside 20% of income for retirement planning. However:

- Younger individuals (e.g., 30s) can start with this percentage as a baseline.

- Older individuals (e.g., 50s) may need to contribute more due to reduced time for savings accumulation.

- Spending during retirement varies:

- While conventional wisdom suggests spending 20% less, frugal individuals may not reduce costs further.

- Some retirees may spend more initially due to increased free time for leisure activities like travel.

7:05 – How much to allocate for retirement?

Calculating Retirement Needs

- Start with Current Expenses:

- Take stock of current expenses to serve as a baseline.

- Adjust these expenses based on anticipated changes after retirement:

- Expenses to remove: Costs tied to children’s education, mortgage loans, and work-related benefits (e.g., insurance for physiotherapy or chiropractor expenses).

- Expenses to add: Include activities like travel, hobbies, or additional healthcare needs that may arise during retirement.

- Consider Inflation:

- Account for long-term inflation, as costs will rise over time.

- For example, if monthly expenses are $5,000 now, inflation at 2.5% annually will significantly increase the required funds in 20-30 years.

10:09 – Is there an amount people can aim for?

Allocating Spare Cash ($8,000/year example)

- Assess Liquidity Needs:

- If funds are needed in 5–10 years:

- Opt for flexible investment options like Treasury Bills (T-bills) or Singapore Savings Bonds (SSBs), which provide returns without long-term lock-ins.

- If funds can be committed until age 55 or beyond:

- Consider topping up your CPF Special Account (SA) for guaranteed 4% returns and potential tax savings.

- If funds are needed in 5–10 years:

- Age-Specific Considerations:

- In Your 20s:

- Prioritize flexibility to accommodate life events (e.g., buying a house, marriage, family planning).

- Balance investments across CPF, short-term instruments (e.g., SSBs), and growth-oriented options (e.g., diversified investments).

- In Your 30s/40s:

- With stable cash flow and commitments, explore retirement income products (e.g., annuities) alongside CPF top-ups.

- In Your 50s and Beyond:

- Focus on building reliable income streams for retirement, emphasizing stability over growth.

- In Your 20s:

11:12 – How to best allocate $8,000?

Importance of Retirement Income

- Dual-Income Strategy:

- Reliable Income:

- Essential to cover fixed retirement expenses, such as housing, healthcare premiums, and daily living costs.

- CPF LIFE provides a safe and predictable annuity income stream.

- Growth-Oriented Income:

- Enables retirees to capture market returns for potential wealth accumulation.

- Investments or retirement plans can supplement CPF payouts.

- Reliable Income:

- Market Risk Example:

- During sharp market declines (e.g., a 10-15% drop), working individuals rely on salaries to mitigate impact.

- Retirees dependent solely on investments may face lifestyle changes, demonstrating the need for reliable income sources.

Tools for Reliable Income

- CPF LIFE:

- Offers stable, guaranteed payouts regardless of market conditions.

- Designed for essential expense coverage.

- May require supplementary plans for higher income needs.

- Retirement Income Plans:

- Provides an additional layer of income security to meet larger or non-essential expenses.

- Protects retirees from drastic lifestyle adjustments due to market fluctuations.

13:22 – When is Retirement Income useful in our retirement planning?

Holistic Retirement Planning

- Formulas for Calculating Retirement Needs:

- Adjust current expenses for post-retirement lifestyle:

- Remove non-retirement costs.

- Add expected retirement-specific expenses like leisure or healthcare.

- Multiply adjusted expenses by anticipated retirement years, factoring in inflation.

- Adjust current expenses for post-retirement lifestyle:

- Budgeting for Retirement:

- General guideline: Save 20% of income annually for retirement.

- Younger individuals (20s/30s): Use this baseline to accumulate wealth gradually.

- Older individuals (50s): May need to save more aggressively due to reduced time for compounding returns.

- Adapting Spending Strategies:

- Conventional wisdom suggests retirees spend less (e.g., 20% reduction), but spending varies based on lifestyle:

- Frugal individuals may maintain current expenses.

- Others may increase spending initially due to travel or leisure activities.

- Conventional wisdom suggests retirees spend less (e.g., 20% reduction), but spending varies based on lifestyle:

Key Considerations for Early Planning

- Evaluate Competing Needs:

- Factor in life goals like marriage, purchasing property, or raising children.

- Balance short-term financial flexibility with long-term savings.

- Leverage CPF Advantages:

- Guaranteed returns in SA ensure steady growth.

- Tax benefits further enhance CPF’s appeal for retirement planning.

Why Consider Retirement Income?

- Options for Fixed Income in Retirement:

- A fixed income can come from various sources:

- Dividend Stocks: Offers potential for consistent payouts but depends on stock performance and dividend policies.

- Bonds: Generally safer and provides regular interest payments, though yields may vary.

- T-bills & SSBs: Risk-free instruments with predictable returns; useful for those prioritizing stability.

- Bank Deposits: Secure but offer relatively low interest rates.

- A fixed income can come from various sources:

- Advantages of Retirement Income Products:

- Provides a simplified, worry-free solution for retirees who prefer not to actively manage multiple financial instruments.

- Instruments like CPF LIFE are designed specifically to ensure reliable and sustainable income streams for life.

- Incorporating Diverse Income Sources:

- Savvy individuals may complement CPF LIFE with other options such as:

- Rental income from property.

- Fixed dividends from blue-chip stocks.

- For the average individual, CPF LIFE and retirement income plans serve as a solid safety net.

- Savvy individuals may complement CPF LIFE with other options such as:

16:03 – Can’t I just supplement my retirement needs with investment?

CPF LIFE Plans and Retirement Sums

- Key CPF Milestones:

- At Age 55:

- CPF Special Account (SA) and Ordinary Account (OA) funds are merged into the Retirement Account (RA).

- Funds in the RA are used to form the basis for CPF LIFE payouts.

- At Age 65:

- CPF LIFE payouts begin, providing retirees with a stable income stream for life.

- At Age 55:

- Retirement Sum Options:

- Basic Retirement Sum (BRS): For those with other income sources or lower expenses (~$800/month payout).

- Full Retirement Sum (FRS): A balanced option (~$1,300–$1,700/month payout).

- Enhanced Retirement Sum (ERS): Ideal for those desiring higher payouts (~$3,000/month payout).

- Choosing CPF LIFE Plans:

- Basic Plan: Lower payouts but leaves more for beneficiaries. Suitable for those with shorter life expectancies or other income sources.

- Standard Plan: Provides maximum payouts at age 65 for a steady income, regardless of lifespan.

- Escalating Plan: Starts with lower payouts but increases by 2% annually, combating inflation. Best suited for those expecting a longer lifespan or higher living costs in later years.

17:00 – Best CPF LIFE plan and best Retirement Sum?

Retirement Planning for Different Ages

- Starting in Your 20s/30s:

- Focus on building a foundation with flexible options:

- CPF Special Account (SA) for guaranteed 4% returns and tax savings.

- Short-term instruments like SSBs and T-bills for liquidity.

- Explore diversified investments (e.g., index funds) for higher potential growth.

- Focus on building a foundation with flexible options:

- Starting in Your 50s:

- Take Stock of Assets:

- Evaluate savings, CPF balances, and investments.

- Identify gaps between existing resources and retirement goals.

- Set Realistic Goals:

- Define retirement age, monthly income needs, and duration.

- Adjust expectations, such as delaying retirement or increasing savings if there’s a gap.

- Take Stock of Assets:

- Kickstarting at Age 50 or Beyond:

- Assess potential for CPF top-ups to reach the Full Retirement Sum (FRS).

- Transfer OA to SA to maximize guaranteed returns.

- Seek professional advice to optimize financial strategies for the remaining working years.

Balancing Retirement Income Sources

- Reliable Income Stream:

- Use stable instruments like CPF LIFE, T-bills, and SSBs to ensure predictable income for essential expenses.

- Rental or dividend income can supplement these sources, offering additional stability.

- Growth-Oriented Income Stream:

- Investments with higher potential returns help capture market growth:

- Diversified portfolios of stocks, REITs, or mutual funds.

- A growth-focused stream supports discretionary spending and wealth accumulation.

- Investments with higher potential returns help capture market growth:

- Combining Multiple Streams:

- Create a two-pronged strategy:

- Essential Income Stream: For fixed costs like housing and healthcare.

- Variable Income Stream: For leisure, travel, or non-essential spending.

- Create a two-pronged strategy:

Why CPF LIFE is Essential

- Advantages of CPF LIFE:

- Stable Lifetime Income: Guaranteed payouts regardless of market conditions.

- Risk-Free Growth: Returns of up to 4% through the CPF Special Account (SA).

- Supplementing CPF LIFE:

- For those seeking higher payouts than CPF LIFE alone can offer, consider retirement income plans or annuities.

- These plans provide an extra layer of financial security in case of market fluctuations or unforeseen expenses.

- Retirement Sum Guidelines:

- Aim for at least the Full Retirement Sum (FRS) to secure a moderate payout (~$1,500/month).

- Consider the Enhanced Retirement Sum (ERS) for maximum payouts (~$3,000/month).

Actionable Steps for Late Starters (50s and Beyond)

- Taking Stock:

- Evaluate total assets, savings, CPF balances, and investments.

- Identify opportunities to maximize CPF contributions or reallocate funds.

- Estimate whether current resources can support your retirement goals.

- Bridging the Gap:

- Increase savings or delay retirement to compensate for shortfalls.

- Reduce income expectations, if necessary, to align with existing resources.

- Optimize Financial Planning:

- Explore CPF top-ups, OA-to-SA transfers, and retirement income plans.

- Consider flexible investments to maintain liquidity while earning returns.

- Seek professional financial advice to create a customized retirement plan.

20:13 – Best way to plan for retirement at age 50?

Biggest Mistakes in Retirement Planning

- Underestimating Coverage Needs:

- Many focus solely on saving and investing, often overlooking the critical role of insurance coverage in securing a retirement safety net.

- Common misconception: Healthy individuals assume they won’t need additional insurance in retirement. However, risks such as long-term illnesses, medical emergencies, or chronic conditions often increase with age.

- Why it matters:

- Health insurance is underwritten based on good health. Waiting until later in life may result in denied applications or prohibitively high premiums.

- Without sufficient coverage, unexpected medical expenses could significantly deplete retirement savings.

22:42 – Biggest mistake people make when it comes to retirement planning

Term Plans vs Whole Life Plans

- Term Plans:

- Designed to cover financial risks during working years, when protecting income is critical.

- Provides coverage against early death, disability, or critical illness.

- Typically ends at retirement (e.g., age 65), leaving no coverage for post-retirement risks.

- Whole Life Plans:

- Lifelong coverage, including retirement years.

- Protects against age-related risks such as increased healthcare costs, long-term care, or chronic conditions.

- Suitable for individuals seeking additional peace of mind post-retirement.

- Changing Needs Over Time:

- During working years:

- Primary focus is on income protection—ensure term plans cover earnings-related risks.

- In retirement years:

- Shift focus to long-term care and medical expenses, as earning capacity is no longer relevant.

- Key takeaway:

- Transition from term plans to more tailored coverage (e.g., health insurance, long-term care insurance) based on evolving needs.

- During working years:

23:39 – Buy term, invest the rest?!

Evaluating Insurance in Retirement

- Adjusting Coverage:

- Retirement shifts priorities from income protection to mitigating healthcare costs and long-term care risks.

- Regular policy reviews are essential to determine which coverages remain necessary and which can be reduced.

- Role of Whole Life Plans:

- Advantages:

- Lifelong protection ensures coverage during critical post-retirement years.

- Supplements savings by reducing the financial burden of medical emergencies.

- Drawbacks:

- Higher premiums compared to term plans may strain finances in earlier years.

- Not always necessary if substantial savings or other medical coverage is in place.

- Advantages:

- Balance Premium Costs:

- Evaluate whether premiums for whole life plans align with retirement budgets.

- Alternative options (e.g., health savings accounts, dedicated emergency funds) may provide similar benefits without ongoing costs.

Actionable Strategies for Retirement Planning

- Coverage Prioritization:

- Ensure adequate insurance coverage (e.g., health insurance, long-term care insurance) while still in good health.

- Start planning early to avoid coverage denial due to pre-existing conditions later in life.

- Transitioning Insurance Policies:

- As retirement approaches, review existing term plans:

- Determine whether coverage remains necessary post-65.

- Replace term plans with targeted health or long-term care policies as needed.

- As retirement approaches, review existing term plans:

- Building a Financial Cushion:

- Allocate savings for healthcare emergencies that might not be covered by insurance.

- Consider diversified investments to support discretionary spending in retirement.

- Seeking Professional Advice:

- Consult financial advisors to develop a tailored plan that balances coverage, savings, and retirement goals.

25:38 – What protections do I need during retirement?

Holistic Retirement Planning: Beyond Insurance

- Integrated Approach:

- Combine income streams such as CPF LIFE, investments, and insurance to create a balanced retirement portfolio.

- Allocate resources to address essential expenses, discretionary spending, and unpredictable medical costs.

- Early Planning for Risk Management:

- Proactively address common retirement risks, including inflation, longevity, healthcare costs, and market volatility.

- Establish reliable income sources to reduce dependency on high-risk investments.

- Coverage as a Foundation:

- Insurance provides a crucial safety net, enabling retirees to allocate savings toward growth and lifestyle needs.

Comprehensive Protection During Retirement

- Key Areas to Prioritize:

- Hospitalization Insurance:

- Aging increases the probability of hospital stays. Coverage like MediShield Life or Integrated Shield Plans ensures accessibility to treatment.

- Options range from basic care in subsidized wards (affordable through MediShield Life) to private hospital coverage (Integrated Shield Plans, at higher premiums).

- Long-Term Care Insurance:

- Essential for disability or dementia-related needs, requiring caregivers or institutional care.

- CareShield Life: Provides a basic payout (~$662/month) for long-term care. Supplements are available to enhance coverage.

- Why It’s Crucial: Dementia prevalence and chronic conditions escalate with age, requiring caregivers or facilities.

- Hospitalization Insurance:

- Critical Illness (CI) and Accident Plans:

- Good to Have:

- CI Plans:

- Useful for supplementing gaps in hospitalization plans (e.g., 5% expenses not covered by Integrated Shield Plans).

- Covers costs for treatment outside hospital stays (e.g., rehabilitation or outpatient care).

- Accident Plans:

- Provides short-term assistance for minor medical needs (e.g., GP visits after accidents).

- Self-Insurance Consideration:

- If CI and accident plans are unavailable, build emergency savings to cover out-of-pocket healthcare costs.

- CI Plans:

- Good to Have:

26:34 – Are critical illness and accident plans a must have during retirement?

Healthcare Costs During Retirement

- Components of Healthcare Costs:

- Insurance Premiums:

- Includes MediShield Life, Integrated Shield Plans, and CareShield Life supplements.

- Premiums rise significantly as you age, particularly for Integrated Shield Plans covering private healthcare.

- Outpatient Costs:

- Covers visits to outpatient specialists, GP treatments, and dental care not covered by hospital plans.

- Often overlooked but a substantial part of retirement healthcare expenses.

- Insurance Premiums:

- Budgeting for Rising Premiums:

- Integrated Shield Plans:

- Costs may become unaffordable by age 75–80 due to steep premium increases.

- Tools like CPF’s Health Insurance Planner can estimate future MediSave sufficiency for premium payments.

- In cases where MediSave cannot cover premiums, cash top-ups become necessary.

- Integrated Shield Plans:

- Strategies to Manage Costs:

- Downgrade from private hospital plans to more affordable public hospital plans if premium costs exceed budget.

- Factor healthcare expenses (premiums + out-of-pocket costs) into overall retirement planning.

Long-Term Care Costs

- Coverage Needs:

- Average Monthly Cost: $3,000 (basic care) based on SingLife’s 2024 study.

- Higher Costs for Enhanced Care:

- Home-based care: Dedicated domestic helpers (~$4,000–$4,500/month).

- Nursing Homes: Costs range from $4,500–$11,000/month, depending on amenities.

- Upgrading CareShield Life:

- Enhance payout beyond the basic $662/month to meet average costs.

- Premium supplements can be partially funded by MediSave (~$600/year), minimizing cash outlay.

- Self-insure if upgrading is financially unviable, by allocating retirement savings to long-term care needs.

- Risk Statistics:

- 50% likelihood of requiring long-term care among Singaporeans aged 65+.

- Care durations range from 4 years (average) to 10+ years for severe conditions like stroke or dementia.

27:42 – How much to set aside for retirement health care cost?

Allocating Limited Budget Across CPF Top-Ups, Investments, and Healthcare Costs

- Step 1: Healthcare Expectations:

- Assess your comfort level with healthcare settings:

- Subsidized public healthcare (affordable with MediShield Life).

- Higher-tier amenities in private hospitals (requires Integrated Shield Plans at higher premiums).

- Assess your comfort level with healthcare settings:

- Step 2: Financial Capability:

- MediShield Life:

- Suitable for basic healthcare needs and sustainable for most MediSave accounts.

- Integrated Shield Plans:

- Offers greater flexibility (doctor selection, private hospital amenities).

- Consider downgrading if premiums strain retirement savings.

- MediShield Life:

- Step 3: Balancing Budget Allocation:

- Health Insurance:

- Prioritize MediShield Life for essential hospitalization coverage.

- Reserve Integrated Shield Plans for higher-tier healthcare only if budget permits.

- CPF Contributions:

- Top up CPF Special Account for guaranteed 4% returns and tax relief.

- Investments:

- Allocate funds for growth-oriented opportunities, ensuring liquidity for future needs.

- Health Insurance:

29:51 – If I have a limited budget, how should I allocate for retirement income vs protection?

Upgrading CareShield Life

- Baseline Payout:

- Basic CareShield Life offers $662/month—insufficient for average costs of $3,000/month.

- Supplement Options:

- Supplements increase payouts, partially funded by MediSave ($600/year).

- Balancing premium costs vs. payout adequacy ensures effective coverage without overspending.

- Extended Care Costs:

- Nursing home ($4,500–$11,000/month) or domestic helper care (~$4,000/month) requires additional savings or premium upgrades.

31:56 – How much CareShield LIfe protection should I get?

Concluding Thoughts

Retirement is the stage of life that many people look forward to because it is finally the time to harvest the fruits of their labour and enjoy them before the journey ends. However, a poorly planned retirement not only dampens the mood but also puts us in a difficult situation where we cannot reverse the clock and have more time to get the finances right. So, it is important to start planning for retirement and at least be ready for it financially, even if you are a late starter at 50.

** SEE MY TRADES & PORTFOLIO ON PATREON ***

If you are interested to find out more about my options trades and investment portfolio, I will be updating them on Patreon (on the same day I made the trades), so do follow me there if you need some reference or inspiration.

*** BUY ME A CUP OF COFFEE ***

If my blog has benefited you in some ways and you would like to offer a token of appreciation, you may do so via this page. Thank you very much for your support!

*** FINANCE BOOKS ***

If you are new to investing, options trading or personal finance and would like to get yourself educated about the fundamentals, you may want to consider these very popular and highly recommended books: One Up On Wall Street, The Psychology of Money, Rich Dad Poor Dad,

*** FREE BEGINNER GUIDE TO OPTIONS TRADING ***

Keen to learn about options trading but do not wish to pay for expensive courses, this newbie guide will help gain the knowledge and fundamentals to understand options better. And it’s totally free!

The Newbie’s Guide To Options Trading

*** FREE MOTIVATIONAL BOOK ***

If earning more money from your investment does not excite you anymore, you may be seeking a purpose that brings fulfillment and meaning in life. I have written a motivational book that may be useful to you in some ways. You can also download a free copy here:

https://learninginvestmentwithjasoncai.com/finding-the-magical-realm-of-happiness-motivational-book

*** FOLLOW US ON SOCIAL MEDIA ***

Follow me on Facebook, LinkedIn, to get notified of my latest posts on social media. Or subscribe to my blog (scroll to the bottom of the page) to have my new posts sent directly to your mailbox.

We also have a community passionate about investing, trading and personal finance over our Facebook group. So, join us there for a good discussion, post queries or share your financial knowledge.