I got a rude awakening on the night of 12 Feb 2025 when I logged onto my brokerage account and saw everything inside gone.

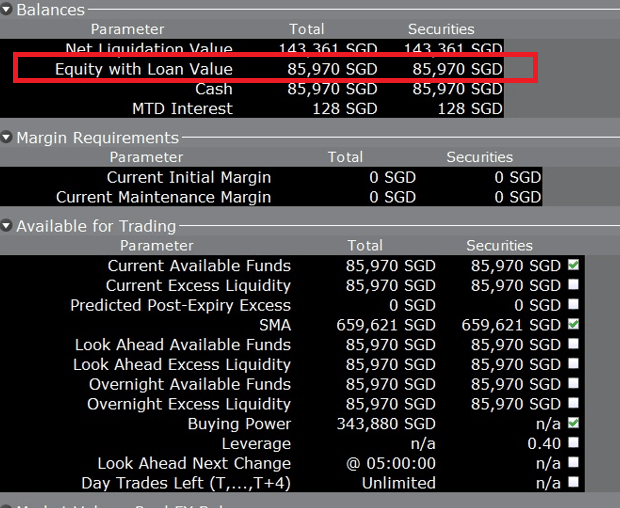

This was a screenshot of my account the day before:

This was what I saw on 12 Feb:

My Equity with Loan Value dropped from 799k to just 86k.

In my main portal, all my shares and options contracts were gone too.

It feels like going out for dinner and coming back home to see the whole house burnt to a crisp, with nothing left.

What Happened Actually?

I immediately called IBKR and was told that there was a margin call imposed on my account as one of my options trade, a vertical spread position, was exercised on one leg, and that created a huge margin deficit.

I opened this position just a month ago to repair a failed Tesla trade, which I converted my BUY CALL options to BULL PUT Spread positions.

More info here:

Repairing My Broken Tesla CALL Options

The brokerage had sent an email to notify me about the Margin Call and proceeded with the liquidation when the market opened on 12 Feb when I did not respond as I was occupied on that day.

I had 15 contracts of BULL PUT Spread on Tesla (Buy USD760 PUT & SELL USD790 PUT) with expiration date in Dec 2025. The SELL PUT leg was exercised, which meant that I had to buy 1500 Tesla shares at USD790 per share, and that translated to USD1.188M, which my account could not take because it only had USD100K cash inside.

In a typical vertical spread position, the max loss is capped because the sell leg is protected by the buy leg. The logical solution is to exercise the Buy PUT that I hold to sell the 1500 shares at USD760 each, which would have raised USD1.14M, which would have left with a deficit of USD48k that could be offset by the advance credit of USD42k that I have received for this position in my account.

Alternatively, the other solution was to sell away the 15 PUT contracts and 1500 new Tesla shares, which would lead to the same outcome of roughly USD6k loss. Instead of doing so, the IBKR went on a rampage and obliterated my entire account, selling all my shares and opened options contract positions that had huge unrealised losses because they were bought at a very wrong time just before the bear market ended. Stocks like Nvidia and Palantir have 10x since that period (early 2023), leading to huge unrealised losses.

The Liquidation Horror

Had I hold onto those positions until their contract expiration date (Dec 26), the losses would be significantly lower because my breakeven price was not very far from the strike prices.

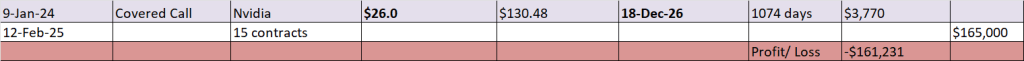

Take this trade, for example. The brokerage realised USD7.92k of losses to close a SELL CALL contract with strike price of USD57. But the actual loss would only be USD300 (breakeven share price minus strike price x 100) when the contract expires on 18 Dec 26, because my breakeven price on Nvidia was USD60.

Similarly, to close my 15 contracts of Nvidia SELL CALL, the brokerage realised USD161.23 k of losses, but the actual loss should be USD51k instead upon expiration.

Actual loss when contract expires ITM on expiration date = [(60-26)x1500].

Ironically, the last batch of contracts that the brokerage sold was the USD760 Buy PUT contracts, and if those were sold first, I would have avoided the huge losses. It felt like Ultron was instructing the IBKR bot army to totally annihilate my portfolio.

Due to the total liquidation of all my options contracts and underlying shares, my total realised loss added up to S$540k (USD400k), which meant that in the last 4 years, I lost almost half a million dollars in options trading. Ouch!

Is This Written In The Stars?

It seems to me that this disaster was destined to happen. I checked in the morning (Singapore time) of 12 Feb and my excess liquidity was still in the acceptable range. I then logged off my IBKR terminal and the massive drop in liquidity was only reflected in the afternoon.

I also missed the margin CALL that was sent via email in the evening. I usually checked my trading account to ensure that the excess liquidity was still alright but somehow on that fateful night, I was occupied with other matters and only managed to log on just after all the selling had been completed.

I went back to check the history of my orders and realised that the system did try sell my Tesla USD760 PUT orders first but was somehow rejected.

Seeing The Silver Lining

In spite of the massive losses, there are some positives from this experience.

For the past year, I have been bothered by liquidity issues for my account due to my options positions and the mistakes that I made in 2023. Now that all positions have been cleared, there is no more liquidity issue to handle and I do not have to constantly worry about the day where my excess liquidity would to negative and I would face liquidation (because the worst case scenario had already happened!)

Previously, I had about USD100k in cash but I could not withdraw them because of my low excess liquidity situation and now that there is no more liquidity issue, I can withdraw the remaining cash position out now, just in time pay for my new house.

I also have a few hundred options contracts before this incident happened and they were complex and hard to manage, and only I knew exactly how to handle them and close them with minimal loss. If I am not around, there is no way that my spouse is able to take over this portfolio. So, with this happening, I no longer am concerned about who is going to help manage my portfolio if I am not able to do so.

What’s Next?

As shocking as it sounds, this is not the first time that I had realised more than S$400k losses for my portfolio. In 2022, something similar happened as my S$400k+ LEAPS portfolio was decimated during the bear market and I realised a loss of S$415k.

[2022 Options Trading Review] 415k Loss, 211k Gain

In 2023, I lost more than $40k as my bearish trades all expired worthless. So, for the 2 years, I had realised losses of more than $450k.

At the end of 2024, I actually broke even on these losses, which means I also earned more than $450k through options trading in the past 4 years.

Before this incident happened, I was actually up $31.7k.

So, I believe all the effort and time spent trying to learn about options trading will not go to waste. I believe I can recoup my losses someday, but it is going to take a longer while as I have a much lower capital now.

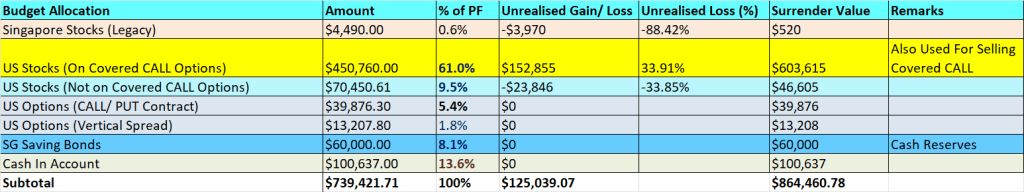

This is a summary of my investment portfolio before the incident happened.

Moving forward, I want to increase my weightage on the safe asset class such as the Singapore Savings Bond (SSB) so that I built a larger risk-free capital allocation in my portfolio before I use the remaining capital on the riskier asset class such as equity and options. This will ensure that I have a large contingency pool that I can tap on if I need money for any last minute big expenses.

Concluding Thoughts

I want to share this disastrous experience even though I know it may invite the hate comments and judgement. But I hope sharing this can help folks who are trading on margins and I urge you to be extra careful as a market crash can wipe you out and cause you to suffer great financial distress.

Also, for those using IBKR, do note that the brokerage will not help you exercise the long leg of your spread if the short leg got exercised and you will then go into margin deficit. And the excess liquidity turns negative, they reserve right to sell anything they wish, and in the worst case scenario like mine, they sold off everything!

Losing a huge chunk of your savings can be the most devastating experience in your life but it is not the end of the world. There are people who went bankrupt first before becoming very successful financially later in life. Money is a tool that we need for survival but beyond that, it is just for enjoyment. There are always means to earn money, as long as we are healthy physically and in the right frame of mind. Also remember that there are many things in life that are more important than money, such as our health and relationships with our loved ones.

I know that $540k (more than half a million dollars) can help me reach certain milestones in life earlier, such as retirement. But I do not dislike my work, my bosses or colleagues so much that I want to break free of all of these and retire early. FIRE (Financial Independence Retire Early) may seem like the in-thing but finding a purpose and living a fulfilling life, before or after retirement, is more meaningful to me than to blindly chase FIRE for the sake of doing it.

The journey to rebuild what I have lost is going to be long and hard, if you are keen to journey with me, do subscribe to my blog so that you can be updated on my progress. You can also join my Patreon page for free as I will be updating my trades on the same day when I made them.

Click here to access my Patreon page

If my blog has benefited you in some ways and you would like to offer a token of appreciation, you may do so via this page. Thank you very much for your support!

Lastly, I wish everyone all the best in your investing or trading journey in 2025. May you never have to suffer the heartache of losing money and that you will get a good return this year.

*** SEE MY TRADES & PORTFOLIO ON PATREON ***

If you are interested to find out more about my options trades and investment portfolio, I will be updating them on Patreon (on the same day I made the trades), so do follow me there if you need some reference or inspiration.

*** BUY ME A CUP OF COFFEE ***

If my blog has benefited you in some ways and you would like to offer a token of appreciation, you may do so via this page. Thank you very much for your support!

*** FINANCE BOOKS ***

If you are new to investing, options trading or personal finance and would like to get yourself educated about the fundamentals, you may want to consider these very popular and highly recommended books: One Up On Wall Street, The Psychology of Money, Rich Dad Poor Dad,

*** FREE BEGINNER GUIDE TO OPTIONS TRADING ***

Keen to learn about options trading but do not wish to pay for expensive courses, this newbie guide will help gain the knowledge and fundamentals to understand options better. And it’s totally free!

The Newbie’s Guide To Options Trading

*** FREE MOTIVATIONAL BOOK ***

If earning more money from your investment does not excite you anymore, you may be seeking a purpose that brings fulfillment and meaning in life. I have written a motivational book that may be useful to you in some ways. You can also download a free copy here:

https://learninginvestmentwithjasoncai.com/finding-the-magical-realm-of-happiness-motivational-book

*** FOLLOW US ON SOCIAL MEDIA ***

Follow me on Facebook, LinkedIn, to get notified of my latest posts on social media. Or subscribe to my blog (scroll to the bottom of the page) to have my new posts sent directly to your mailbox.

We also have a community passionate about investing, trading and personal finance over our Facebook group. So, join us there for a good discussion, post queries or share your financial knowledge.

May I ask why you use margin??? The risks far outweigh the benefits …

LikeLike

Hi, the margins account is necessary for vertical spread options trading, but the reason I used margins is to repair my broken Covered CALL trades that locked up my shares for a long time. I converted SELL CALL to SELL PUT so that I can released those shares locked by Covered CALL when I sold at the worst possible time before the end of the bear market in early 2023. By doing so, my SELL PUT was not fully cash secured and I used some margin to support the trade. But this margin call & liquidation was not entirely because I took too much leverage on margins, it is just an early assignment, which triggered a domino effect of massive selling and total liquidation.

LikeLike

The greatness of a man lies in his ability to rise again every time after falling down and not in never falling down. Know that this too shall pass and a few years from now you will be able to view this experience as just a mist in air. You will have many stories that you can narrate to your children and grandchildren. All the very best and may you recover quickly from this temporary setback.

BKB Krish

bkbatljc@gmail.com

LikeLike

Thank you so much Krish for your encouraging words, I really appreciate them 🙂

LikeLike

Hi thanks for sharing valuable experience. May I check does the margin call liquidation affect all your accounts (I.e. 1 user login can ideally open many margin and non margin accounts) or liquidation happen only that particular account with assignment notice ?

thanks in advance.

LikeLike

Hi Kuri, I have another cash account under my name and there is $28k inside and it was not affected by the liquidation. So, the liquidation only happens on that particular account where there is a margins deficit.

LikeLike

I read through this and still don’t understand how you took a -$480k SGD loss when you had $800k sgd equity with loan value.

What was your unrealized gains / loss before TSLA -790p (15 of them) got exercised? That -790p/760p bull put spread should have had max loss at $2 ($28 was collected) x 15 ~ $3k USD despite it being exercised?

As IBKR would have forced sold the 760p leg which would have been worth as you had stated – despite it being liquidated last.

Not getting the picture here, unless you collected a lot of short call / covered call premium that was far dated in the future Dec 2026 like your NVDA -60c Dec 2026… which is not realized really because the premium hasn’t decayed…..

LikeLike

Hi Clement, if you refer to my previous update on my portfolio, you can see I have about S$860k if I sell all my shares and bond. If minus the 60k SSB, it will be around 800k of ELV. The 480k unrealised loss comes from me receiving very low premium when I sold CALL in early 2023 and because the share prices of both Palantir and NVDA have 10x, the premium skyrocketed. It is a LEAPS CALL with expiration in Dec 26 so Theta does not have much impact. I also sold CC when Tesla was around 100+ then it went to 400+, so premium also increased by a lot. When all these all together, it becomes 480k. Actually should be 496k as I am already 16k up before the liquidation happened. Fyi, I own 30 SELL CALL contracts on Nvidia (SP USD26), 5 SELL CALL Contract on Tesla (SP USD230) and 5 SELL CALL on Palantir (SP USD8).

LikeLike

I feel it’s the brokerage fault. shouldn’t happen like this for verticals. i faced similar nonsense from them, don’t have same issue with other platform.

LikeLike

Yup, I heard other brokerages can help to exercise the other leg to close the trade. Sigh.

LikeLike

Hi Jason,

Thanks for your sharing across the years. However, I don’t understand how you get such a big loss – was it already unrealised losses and IBKR just close all your positions and realise it for you due to the TSLA options? since your Net Liquidation Value is similar before and after the liquidation event.

Also, why did you choose not to close your CC immediately at a loss in 2023 but continue to roll it?

All the best and hope you managed to recover them but perhaps reviewing the options strategy now?

Jamie

LikeLike

Hey Jamie, thanks for your kind words! Yes, it was already unrealised because I sold those Covered CALL positions when the share prices of the underlying shares were very low back in early 2023. Stocks like Nvidia & Palantir have since 10x so the unrealised loss is huge. I know I should have closed it but I thought I could hold it till expiration date because I am backed by underlying shares and my average price is not very high either. On hindsight, I should have cut loss on these CC positions early when the market was turning bullish 2023, just like my LEAPS CALL positions, when I should have exited when the market turns bearish in 2022. I hope things are better over at your side, all the best too 🙂

LikeLike

why did u sell such a deep in the money put? That’s always risky and runs a risk of getting assigned when someone else triggers the buy out option no?

LikeLike

Hi Ivan, thanks for asking, I actually wanted to use a lower capital as collateral, because in this USD760/790 spread, the premium is 28, which means max loss is 200, while max gain is 2800, risk to reward is 1:14. I had avoided the highest SP of USD960 and thought that USD790 is safe and has low risk of getting early assignment. But, I was totally blindsided by the early assignment and that led to a domino effect of liquidating my entire portfolio.

LikeLike

This is making me thinking about entering a TSLA bull put spread. That’s a pretty good risk to reward ratio.

LikeLike

Hi Anuj, if you have enough cash to cover your trade just in case it gets assigned, then you are safe. Another method if you do not have enough cash is to monitor your account closely, just in case it gets assigned. The last method is to find a brokerage that can help you auto exercise the other leg if one leg gets exercised. All the best!

LikeLike

Hi Jason, I’m so sorry for your losses. I’m abit confused. Your ELV was $799k and it dropped to $86k after the incident. Why was the loss not $713k?

LikeLike

Hi James, oh there is still one Telsa USD760 PUT contract left which I sold later for around US41.8k. Add that in, ELV is around 142k. 800k – 142k = 658k, which is roughly what all my shares are worth before they are liquidated. ELV = Value of shares + options contracts (if any) + spare cash. Hope this clarifies.

LikeLike

oh dear, from your portfolio prior to the incident, it would appear what is left are the legacy sg stocks, 60k SSB and US$ 100k (which would be used to pay for the new house)? If so, it is going to be a long and hard slog ahead to rebuild.

You are indeed correct to focus on building up ur emergency cash right now. The job market isn’t rosy. Your new house may just be ur best investment yet.

LikeLike

I would want to understand why what you want to go into risky instruments. Is it because you cannot wait to gain a huge amount of capital in a short period of time?

LikeLike

Actually, are you assuming the buyer will not exercise the deep in the money call or puts before expiry because of the huge cash outlay required? And IBKR did not autoexcerise the other leg because there is no response to the email they sent you?

LikeLike

Nope, the cash outlay is on my end and buyer on the other end just need to sell his shares when he exercised the options contract. But yes, I didn’t expect it to be exercised as it is not deep ITM, as in the extreme end of the SP available, i.e. USD960. IBKR will not auto-exercise regardless if there is any response to the margin CALL, they will liquidate whatever is necessary to bring the liquidity back to positive level again.

LikeLike

the broker is simply closing the positions that are down massively and wont be able to come back. this is to free up the collateral needed to maintain these positions. its a matter of time before these positions are closed anyway. Its just the margin deficit hasten the process and closed those profitable positions along with it.

LikeLike

The loss would be lower if these contracts run its course and expire ITM where my shares would be sold at the strike prices stated in the Covered CALL contracts, and these prices that the share are going to be sold will not be too far away from my average purchase price, thus resulting in a lower loss. Also, if there is a stock market crash happening in the future before the expiration of the contracts, it would lower the unrealised losses significantly. I had some CC positions in Tesla turning profitable when Tesla was trading around USD140+. So, it is not a sooner or later thing that these huge losses materialized.

LikeLike