On 13 Nov 24, I reached a milestone in my options trading journey. It was the first time since Nov 2022 (2 years ago) that my total nett returns in options trading is positive, which means that I broke even on my all losses in options trading, including the huge losses of S$415k loss in 2022 and $41k loss in 2023.

The below is my records from the start of my options trading journey (Feb 21) to the current month (Nov 24). You can see the roller-coaster ride as I accumulated up to S$287k of profits in Aug 22 only to lose them all and go into the red in Sept 22.

The loss continued to snowball until the max of S$56k in Sept 23 before things start to improve again as I cut the loss gradually each month. If you are keen to find out how I manage to recoup my loss over the months, you can refer to my winning trade records on my Patreon page.

Click here for my Profitable Trades Collection

A Brief Recap

I still remember vividly my options trading journey started in late Feb 2021, after months of self-learning on YouTube and the Internet, my first trade was to sell a Cash-secured PUT on Apple. I was very cautious back then and only tried out the safe strategies, e.g. Wheel Strategy.

Along the way, as profits grow, I started to get more adventurous and took on more risks by buying OTM CALL options for quick profits and this method worked quite well initially. However, I did not foresee the bear market that was coming in 2022, as inflation and high interest rates imposed by the Fed crashed the market.

Looking back, there are quite a number of memorable experiences in this options trading journey and I have shared them on this blog, such as getting MARGIN CALL when a seemingly safe trade went wrong:

I Was Margin Called & Got Liquidated For Owing My Brokerage USD1.44M | What To Do When You Get Margin Call | How To Prevent Liquidation

My first glorious year in options trading with lots of beginner luck was a dream start:

1st Year Options Trading Recap: The Journey Towards SGD$217,509 Profits In 2021

The nightmare came in the second year when share prices started falling like the world was ending soon, which then resulted in me losing a lot of money, much more than what I have earned:

I Closed All My Remaining LEAPS CALL Positions At A Total Loss of SGD415K (USD306K)

I also came out with a newbie guide to explain options trading in layman terms to any newbie who is interested to learn more:

The Newbie’s Guide To Options Trading

Net Investment Returns

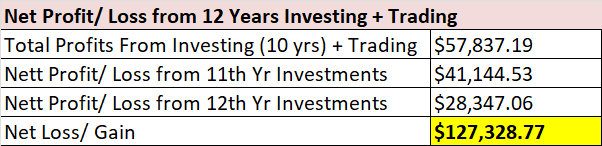

Outside options trading, my investment portfolio yields a modest return and this includes the interest collected from Singapore Savings Bonds (SSB), as well as dividends from shares and the profits from selling shares.

I am thankful for this gain as I made some really bad investments in my first 10 years of investing journey, which includes buying into O&G stocks such as Sembcorp Marine, Marco Polo Marine and sunset business like SPH, that resulted in me cutting $135k of losses eventually.

Read more here: I Cut $135,715 Worth Of Losses In The Last 1.5 Months

Concluding Thoughts

If I was told at the start of this journey that I would be back to square one (and earned nothing) after almost 4 years of trading, I probably would not have even started on it. However, after going through the ups and downs of this self-learnt options trading journey, I have learnt many lessons that has helped me to improve as an investor and trader, and increase my chances of being profitable.

I also realised that what worked the first time round may not work forever. Take for example, I made 6 figures gain using the LEAPS strategy in 2021 but that strategy made me lose almost all of $400+k LEAPS portfolio in 2022. I then earn a lot of premium selling Covered CALL at very low strike prices in the bear market of 2022, only to be caught off guard and got stuck on many Covered CALL positions when the market turned bullish in 2023. These stuck Covered CALL positions meant that I either have to suffer a huge loss to close the contracts or have to sell them at a very low price when the contract expires (which is also a big loss).

Lastly, my advice to all newbies who are keen to jump onto the options trading bandwagon is to always manage your risk by being aware of how much you have traded and your potential loss if things go terribly wrong. We all have no issues handing phenomenal gains but the biggest challenge is to stomach the loss when it happens most unexpectedly.

To avoid losing everything, set aside an insignificant portion of your portfolio for options trading, which has higher risk, while keeping the rest of your capital for long-term investments. That may just protect your account from being wiped out due to bad trades/ decisions.

I hope this sharing has been useful in some ways. If you need further information or have any queries, please feel to get in touch or leave a comment. I wish you all the best in investing or trading, may you find success in what you do.

*** SEE MY TRADES & PORTFOLIO ON PATREON ***

If you are interested to find out more about my options trades and investment portfolio, I will be updating them on Patreon (on the same day I made the trades), so do follow me there if you need some reference or inspiration.

*** FINANCE BOOKS ***

If you are new to investing, options trading or personal finance and would like to get yourself educated about the fundamentals, you may want to consider these very popular and highly recommended books: One Up On Wall Street, The Psychology of Money, Rich Dad Poor Dad,

*** EARN FREE MONEY ***

Sign up for WeBull Securities Brokerage and sure-win free shares:

Receive Free Money When You Sign Up With WeBull Securities Platform

*** FREE BEGINNER GUIDE TO OPTIONS TRADING ***

Keen to learn about options trading but do not wish to pay for expensive courses, this newbie guide will help gain the knowledge and fundamentals to understand options better. And it’s totally free!

The Newbie’s Guide To Options Trading

*** FREE MOTIVATIONAL BOOK ***

If earning more money from your investment does not excite you anymore, you may be seeking a purpose that brings fulfillment and meaning in life. I have written a motivational book that may be useful to you in some ways. You can also download a free copy here:

https://learninginvestmentwithjasoncai.com/finding-the-magical-realm-of-happiness-motivational-book

*** FOLLOW US ON SOCIAL MEDIA ***

Follow me on Facebook, LinkedIn, to get notified of my latest posts on social media. Or subscribe to my blog (scroll to the bottom of the page) to have my new posts sent directly to your mailbox.

We also have a community passionate about investing, trading and personal finance over our Facebook group. So, join us there for a good discussion, post queries or share your financial knowledge.

*** BUY ME A CUP OF COFFEE ***

If my blog has benefited you in some ways and you would like to offer a token of appreciation, you may do so via this page. Thank you very much for your support!

*** MUST-READ BLOG POSTS ***

After accumulating more than 600k of unrealized losses on my portfolio, I wrote this article to encourage friends and investors who are also losing a lot of money to the market.

If You Are Feeling Depressed From Losing Lots Of Money In The Stock Market, Here’s An Article For You

In the 10 years of my investing journey, I have made many mistakes but also learned many lessons from these mistakes. I compiled the 10 most valuable lessons that I have learned and may they help you succeed in your investing journey.

Happy 10 Years Of Investing | 348k (Realised) Profit, 635k (Unrealized) Loss & 10 Lessons Learnt

The precious 6 lessons I learnt after cutting more than half a million of losses in the stock market through bad investments and risky trades.

6 Lessons Learnt After Losing 551k In 10 Years Of Investing & Options Trading | What Newbies Should Know They Start Investing/ Trading

How I managed to build a 1M investment/ trading portfolio despite coming from humble beginnings.

How A Poor Kid Got To A 1M Investment Portfolio | Tips & Principles Of Building Wealth

I did these 10 side hustles while holding a full-time job, so I share them here so you can be inspired to grow your wealth through a side hustle that you enjoy.

I Did These 10 Side Hustles While Working Full Time | 10 Side Hustle Ideas To Help You Earn An Extra Income

Struggling with inflation and high cost of living? Try these 10 methods to help you save money and accumulate more savings for investments or rainy days.

10 Ways To Save Money To Help You Fight Inflation & Rising Costs Of Living

Why I am building $120,000 of cash reserves in Singapore Savings Bonds (SSB) & 5 reasons why I think SSB is a worthy low or zero-risk investment that you can consider.

Why I Am Building $120,000 Of Cash Reserves In Singapore Savings Bonds (SSB)? | 5 Reasons Why SSB Is A Worthy Low-Risk Investment

Sharing why I am doing Dollar Cost Average (DCA) into SPY and QQQ ETF for long-term investments and a step-by-step guide to doing it automatically with Interactive Brokers.

Why I Am Doing DCA (Automatically) For SPY & QQQ For My Long Term Investment? (20% ~ 30% Upside Potential) | Step By Step Guide To Activating Automatic Recurring Investment On IBKR

Can options trading provide you with extra sideline income every month? In this post, I share my experience of generating income from options trading over the last 3 years.

Options Trading For Passive Income: Truth Or Myth?