I will remember 5 Aug 24 (Monday) as one of my darkest trading days and I want to share my experience and thoughts in this article. The market had started to sell off on the last 2 trading days of the previous week but I still managed to have 15k of excess liquidity left in my account prior to 5 Aug 24.

On the day itself, I received this email notification just a few hours before the market opened, that my account was down by a huge amount.

I then went to my IBKR mobile app and was shocked that my account had -15.6k of excess liquidity. That happened because of a market meltdown where investors were spooked by Japan’s sudden increase in interest rate, recessionary fears and tension between Iran and Isarel.

As a result, there was a huge sell-off (more than 10%) for my two biggest holdings, Tesla and Nvidia. My excess liquidity dropped sharply to the negative region due to the massive drop in share prices for the two mentioned stocks. If nothing was done, my brokerage would liquidate my shares to make excess liquidity back to zero when the market opened.

I used some of the methods described in my previous post to try to restore my liquidity but it was in a free-fall mode. I had to sell off many of my Nvidia, Tesla and Palantir shares, at prices that are far from my target price to sell.

After checking with IBKR, I realised that I could sell off shares in the premarket and I did exactly that, to ensure that my excess liquidity was not negative when the market opened on 5 Aug 24.

Here are the details of the price of shares when I sold and the quantity sold.

SOLD 1 NVDA @ 96.94

SOLD 9 NVDA @ 96.6

SOLD 10 TSLA @ 191.42

SOLD 100 TSLA @ 189.065

SOLD 100 NVDA @ 95.26

SOLD 500 PLTR @ 21.72

SOLD 100 NVDA @ 91.66

SOLD 100 TSLA @ 186.92

SOLD 500 PLTR @ 20.87

In summary, I sold 210 Nvidia at around USD93 per share, 210 Tesla shares at around USD188 and 1000 Palantir shares at around USD21.30. Based on my breakeven prices of Nvidia, Tesla and Palantir at USD121.4, USD350 and USD26.9, that would amount to realised losses of:

(121.4 – 93) x 210 = 5.96k

(350 – 188) x 210 = 19.44k

(26.9 – 21.3) x 1000 = 5.6k

that adds up to a total of USD31k!

Market Open & Closing Options Contracts At Loss

After the premarket mass-selling, my excess liquidity was hovering around the zero mark and it was a precarious situation to be in. So, I had to close some options positions to prevent the excess liquidity from dropping below zero again.

I closed my GOOGL SELL PUT to increase excess liquidity by USD4k, at a loss of -USD2.3k.

BOUGHT 1 GOOGL Dec18’26 185 PUT @ 40

I also closed my Tesla SELL PUT to increase liquidity by USD6k, at a loss of -USD3.5k.

BOUGHT 1 TSLA Jun18’26 270 PUT @ 101.5

I also sold some of my Nvidia BCS positions to increase the excess liquidity further, at a loss of -USD1.47k

SOLD 20 NVDA-COMB @ 0.7455

All these trades and subsequent market recovery eventually brought up my excess liquidity to around +27k, which I thought could give me some cushion for the following day, just in case the crash continued. But all these came at a total realised loss of USD38k from my portfolio.

Concluding Thoughts

I learnt a few lessons through this heavy loss and one of them is that with high leverage comes high risk. I was highly leveraged because I used a method to fix my broken Covered/ naked SELL CALL contracts by converting them into SELL PUT contracts.

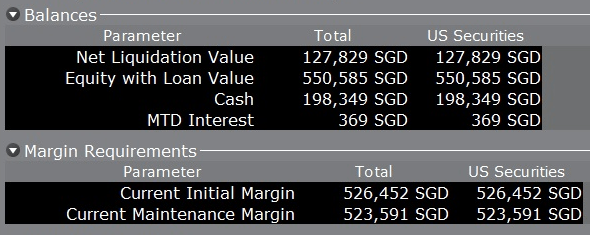

I had 523k of maintenance margins, mainly because of the high margins required to support these SELL PUT contracts (in the event of early assignments, margins would be used to buy those shares when I do not have enough cash, which would be followed by margin call and forced liquidation when I am not able to repay the margin loan).

In the event of a sudden crash like 5 Aug 24, my asset value (equity with loan value) dropped and the excess liquidity (equity with loan value minus maintenance margin) dropped alongside with it. So, it was painful but necessary to close the SELL PUT contracts to reduce the maintenance margin because there is no guarantee that the market would recover, as a bad earnings from Palantir or bad unemployment data released later that week would have crashed the market further.

The silver lining from this episode is that my cash position has increased through the sale of stocks and I have freed up more capital to buy stocks at a lower price, which may eventually rise again and brings me profits to offset my current losses. It is dampening for me after finally hitting the 4 digit loss on options trading and going back to 5-digit loss after this episode. However, this journey is always going to have its ups and downs. I believe in looking at the long term horizon and there will always be opportunities to make money as long as we stay patient and safe.

*** SEE MY TRADES & PORTFOLIO ON PATREON ***

If you are interested to find out more about my options trades and investment portfolio, I will be updating them on Patreon (on the same day I made the trades), so do follow me there if you need some reference or inspiration.

*** FINANCE BOOKS ***

If you are new to investing, options trading or personal finance and would like to get yourself educated about the fundamentals, you may want to consider these very popular and highly recommended books: One Up On Wall Street, The Psychology of Money, Rich Dad Poor Dad,

*** EARN FREE MONEY ***

Sign up for WeBull Securities Brokerage and sure-win free shares:

Receive Free Money When You Sign Up With WeBull Securities Platform

*** FREE BEGINNER GUIDE TO OPTIONS TRADING ***

Keen to learn about options trading but do not wish to pay for expensive courses, this newbie guide will help gain the knowledge and fundamentals to understand options better. And it’s totally free!

The Newbie’s Guide To Options Trading

*** FREE MOTIVATIONAL BOOK ***

If earning more money from your investment does not excite you anymore, you may be seeking a purpose that brings fulfillment and meaning in life. I have written a motivational book that may be useful to you in some ways. You can also download a free copy here:

https://learninginvestmentwithjasoncai.com/finding-the-magical-realm-of-happiness-motivational-book

*** FOLLOW US ON SOCIAL MEDIA ***

Follow me on Facebook, LinkedIn, to get notified of my latest posts on social media. Or subscribe to my blog (scroll to the bottom of the page) to have my new posts sent directly to your mailbox.

We also have a community passionate about investing, trading and personal finance over our Facebook group. So, join us there for a good discussion, post queries or share your financial knowledge.

*** BUY ME A CUP OF COFFEE ***

If my blog has benefited you in some ways and you would like to offer a token of appreciation, you may do so via this page. Thank you very much for your support!

*** MUST-READ BLOG POSTS ***

After accumulating more than 600k of unrealized losses on my portfolio, I wrote this article to encourage friends and investors who are also losing a lot of money to the market.

If You Are Feeling Depressed From Losing Lots Of Money In The Stock Market, Here’s An Article For You

In the 10 years of my investing journey, I have made many mistakes but also learned many lessons from these mistakes. I compiled the 10 most valuable lessons that I have learned and may they help you succeed in your investing journey.

Happy 10 Years Of Investing | 348k (Realised) Profit, 635k (Unrealized) Loss & 10 Lessons Learnt

The precious 6 lessons I learnt after cutting more than half a million of losses in the stock market through bad investments and risky trades.

6 Lessons Learnt After Losing 551k In 10 Years Of Investing & Options Trading | What Newbies Should Know They Start Investing/ Trading

How I managed to build a 1M investment/ trading portfolio despite coming from humble beginnings.

How A Poor Kid Got To A 1M Investment Portfolio | Tips & Principles Of Building Wealth

I did these 10 side hustles while holding a full-time job, so I share them here so you can be inspired to grow your wealth through a side hustle that you enjoy.

I Did These 10 Side Hustles While Working Full Time | 10 Side Hustle Ideas To Help You Earn An Extra Income

Struggling with inflation and high cost of living? Try these 10 methods to help you save money and accumulate more savings for investments or rainy days.

10 Ways To Save Money To Help You Fight Inflation & Rising Costs Of Living

Why I am building $120,000 of cash reserves in Singapore Savings Bonds (SSB) & 5 reasons why I think SSB is a worthy low or zero-risk investment that you can consider.

Why I Am Building $120,000 Of Cash Reserves In Singapore Savings Bonds (SSB)? | 5 Reasons Why SSB Is A Worthy Low-Risk Investment

Sharing why I am doing Dollar Cost Average (DCA) into SPY and QQQ ETF for long-term investments and a step-by-step guide to doing it automatically with Interactive Brokers.

Why I Am Doing DCA (Automatically) For SPY & QQQ For My Long Term Investment? (20% ~ 30% Upside Potential) | Step By Step Guide To Activating Automatic Recurring Investment On IBKR

Can options trading provide you with extra sideline income every month? In this post, I share my experience of generating income from options trading over the last 3 years.

Options Trading For Passive Income: Truth Or Myth?

bro. your net liq is around 127k sgd now? at one time i tot u put in as much as sgd1 million in the account? or i am missing something here. so this option journey has depleted nearly 900k? from your capital assuming u liquidate all your positions today?

i find your strategy to be overly aggressive bro particularly at the beginning. u are not managing your portfolio delta in a way that minimises such wild swings.

when black monday hit, my p/l ytd went into the red at one point but because many of my trade structures are hedged, there is no risk of a margin call even when the whole market goes deep red. now with the rebound, the p/l ytd is already back to pre black monday levels. I supposed you just discovered that is not possible for your case as you were force to liquidate some of your positions at the worst possible time.

u have to decide what is your objective when you set up your trade structures bro. is it to generate consistent income (to stay rich) or outsized gains (to get rich). i believe you started with trying to achieve outsized gains especially when the structures worked for you in 2020-21. then u sort of switch to a capital preservation mode when market tanked in 2022 but still maintaining an aggressive stance (with large number of contracts).

not being cleared eyed about the goals and deploying the appropriate trade structures is the no 1 reason why many option traders blow up their accounts.

LikeLike

Hey Bro Raymond, thanks for dropping by and giving your valuable advice. I made two big mistakes in 2023 and now I am reaping the consequences of the mistakes, one was to sell CC on Nvidia before it bottomed and rocket at the start of 2023 and the second was to go naked on my SELL CALL by selling 2000 Nvidia shares away at USD40+ to free up some cash for other purpose. Without any hedge using CALL options back then, I allowed my unrealised losses in the SELL CALL position to keep increase with Nvidia’s phenomenal rise in share price. I then tried to fix the problem by converting SELL CALL into SELL PUT and my maintenance margins went up considerably. All was going well when market was good until the black Friday came, when the excess liquidity dropped significantly.

LikeLike

Hi Jason

Hope u are still doing ok with the recent sell off. I suspect u could be facing some margin pressures from the broker again. Looks like your NVDA structure is locked in a minimum loss no matter how the stock price move. You need to be aware of your overall delta for individual positions as well as overall portfolio. This will allow u to make better decisions on what trade structures to add. Most option traders start out with constructing structures that seeks to earn a consistent income (e.g. the popular wheel) but some will get side tracked and try to go for outsized gains (e.g. a simple long put or long call). its ok to do it as long as the the sizing and delta is managed well. Trouble starts when structures are abused. E.g. running a hi delta wheel strategy with large number of contracts on margin. Actually a low risk long DITM LEAP call would be more suited for the job if one is particularly bullish on a stock. This is what I meant by being clear eyed on the goals and using the appropriate structure to do the job. cheers.

Raymond

LikeLike

Thank you Bro Raymond for your concern, indeed the recent selloff has caused liquidity issue, I actually sold off 200 NVDA shares to reduce my maintenance margins but I am back to 200 shares naked. My entire trading portfolio now hinges on the fate of Tesla and Nvidia. If they plunge, then I am in deep trouble. Hope the market can recover soon and that I will have the chance to mend whatever is broken and not burnt down by then. Nevertheless, I do very much appreciate your advice and kind thoughts 🙂

LikeLike