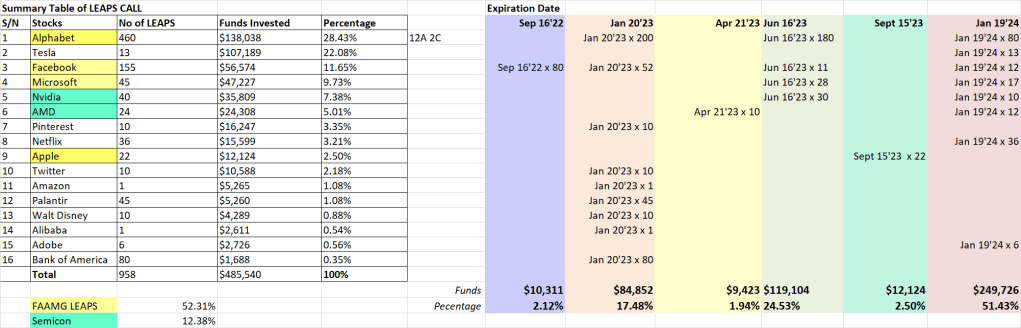

In my previous update on my LEAPS CALL portfolio, I share about the total capital allocation for each company as well as the total capital allocated for the respective contract expiry dates.

My spreadsheet also contains the details of all the 958 options contracts that I have bought, e.g. date of purchase, premium paid, share price when I purchase the CALL options…etc.

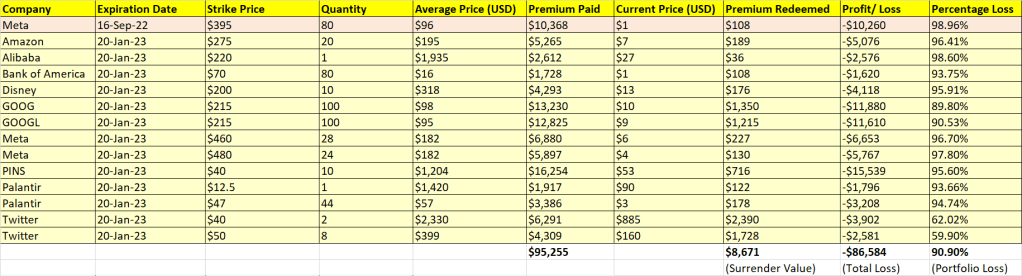

I came out with a new table to help me have a better overview of the profit/ loss of each position, so I can plan the strategies ahead. The options contracts are consolidated by the same strike price and expiry date, which are further sorted by expiration date.

From this table, I also know my total unrealized loss and the capital that I can redeem if I were to sell everything now. As you can see from the above table, my 485k portfolio is currently down by 75%. If it is not for the recent tech rally as well as me buying some new contracts to average down on the longer expiration dates of CALL options, the percentage loss would be higher.

Most of the CALL contracts that are expiring soon (between now to Jan 2023) are suffering heavy losses (more than 90%). This is due to Theta (time) decay and the fall in stock prices in the last 8 months. It is likely that I will suffer heavy losses in these options contracts expiring by Jan 2023, or lose all $95,225 capital on these positions.

For the options contract expiring between June 2023 to Jan 2024, it is more hopeful because the percentage loss ranges from 37% to 97%. Other than having more time value left in the contracts, I have been buying over the past few weeks to bring down the average price of some positions.

What Is My Plan Moving Forward?

I am considering selling the options contracts that are expiring by Jan 2023 to realize the unrealize loss but at least salvage some capital instead of letting all of them expire worthless. My Sept 22 Meta CALL option contracts have become worthless more than one month before expiration date (premium usually decay exponentially in the last month of contract), so it is important for me to act fast instead of wait till November or December 2022 to act for the options contracts expiring in Jan 2023. If the rally is not going to continue or if the market is going to stay sideways for the next few months (Aug to Nov), it will be better for me to sell off these CALL contracts before they become worthless.

As of today, I can still salvage $8,671 from the $95,255 invested capital if I were to sell off all the contracts expiring by Jan 2023. That would constitute to a $86,584 or 90.9% loss on the invested capital.

I can then invest these capital onto the LEAPS CALL options contracts that are expiring in June 2023 to Jan 2024. If the market rises thereafter, I will still benefit from those LEAPS CALL contracts. If the market tanks, I will not risk losing these contracts and 100% loss when they expire worthless.

I will observe the next couple of weeks to see how the market is performing and making a decision by end of the month. If anytime I sense that the market trend is reversing and the rally is ending, I will do a painful cut loss on these counters, so that I can live to fight another day.

*** SEE MY TRADES & PORTFOLIO ON PATREON ***

If you are interested to find out more about my options trades and investment portfolio, I will be updating them on Patreon (on the same day I made the trades), so do follow me there if you need some reference or inspiration.

*** EARN FREE MONEY ***

Sign up for WeBull Securities Brokerage and sure-win free shares:

Receive Free Money When You Sign Up With WeBull Securities Platform

*** FREE BEGINNER GUIDE TO OPTIONS TRADING ***

Keen to learn about options trading but do not wish to pay for expensive courses, this newbie guide will help gain the knowledge and fundamentals to understand options better. And it’s totally free!

The Newbie’s Guide To Options Trading

*** FREE MOTIVATIONAL BOOK ***

If earning more money from your investment does not excite you anymore, you may be seeking a purpose that brings fulfillment and meaning in life. I have written a motivational book that may be useful to you in some ways. You can also download a free copy here:

https://learninginvestmentwithjasoncai.com/finding-the-magical-realm-of-happiness-motivational-book

*** FOLLOW US ON SOCIAL MEDIA ***

Follow me on Facebook, LinkedIn, to get notified of my latest posts on social media. Or subscribe to my blog (scroll to the bottom of the page) to have my new posts sent directly to your mailbox.

*** BUY ME A CUP OF COFFEE ***

If my blog has benefited you in some ways and you would like to offer a token of appreciation, you may do so via this page. Thank you very much for your support!

*** MUST-READ BLOG POSTS ***

After accumulating more than 600k of unrealized losses on my portfolio, I wrote this article to encourage friends and investors who are also losing a lot of money to the market.

If You Are Feeling Depressed From Losing Lots Of Money In The Stock Market, Here’s An Article For You

In the 10 years of my investing journey, I have made many mistakes but also learned many lessons from these mistakes. I compiled the 10 most valuable lessons that I have learned and may they help you succeed in your investing journey.

Happy 10 Years Of Investing | 348k (Realised) Profit, 635k (Unrealized) Loss & 10 Lessons Learnt

The precious 6 lessons I learnt after cutting more than half a million of losses in the stock market through bad investments and risky trades.

6 Lessons Learnt After Losing 551k In 10 Years Of Investing & Options Trading | What Newbies Should Know They Start Investing/ Trading

How I managed to build a 1M investment/ trading portfolio despite coming from humble beginnings.

How A Poor Kid Got To A 1M Investment Portfolio | Tips & Principles Of Building Wealth

I did these 10 side hustles while holding a full-time job, so I share them here so you can be inspired to grow your wealth through a side hustle that you enjoy.

I Did These 10 Side Hustles While Working Full Time | 10 Side Hustle Ideas To Help You Earn An Extra Income

Struggling with inflation and high cost of living? Try these 10 methods to help you save money and accumulate more savings for investments or rainy days.

10 Ways To Save Money To Help You Fight Inflation & Rising Costs Of Living

Why I am building $120,000 of cash reserves in Singapore Savings Bonds (SSB) & 5 reasons why I think SSB is a worthy low or zero-risk investment that you can consider.

Why I Am Building $120,000 Of Cash Reserves In Singapore Savings Bonds (SSB)? | 5 Reasons Why SSB Is A Worthy Low-Risk Investment

Sharing why I am doing Dollar Cost Average (DCA) into SPY and QQQ ETF for long-term investments and a step-by-step guide to doing it automatically with Interactive Brokers.

Why I Am Doing DCA (Automatically) For SPY & QQQ For My Long Term Investment? (20% ~ 30% Upside Potential) | Step By Step Guide To Activating Automatic Recurring Investment On IBKR

Can options trading provide you with extra sideline income every month? In this post, I share my experience of generating income from options trading over the last 3 years.

Options Trading For Passive Income: Truth Or Myth?

the calls are way too far OTM and the deltas close to 0. Any rise in share price will make little to no impact on the call price. instead you getting time decay daily. unless you expect the underlying to make a super huge move, i agree taking back something is better than nothing.

LikeLiked by 1 person

Thanks for sharing your thoughts on this, YL. I probably exit these positions when the current rally is showing signs of reversal.

LikeLike

Hi Jason

Just exchanging notes here. I know you are on IBRK. For TOS, they have various levels of option approval starting with (cash account) and ending with (cash, options and margin account) (highest level). Highest level allows one to sell naked calls without the stocks to cover. That is one can trade call spreads without stock cover.

Does IBRK have something similar? Cos I wondering whether you are able to sell naked calls based on your existing account level or every short option trade has to be covered. i.e. full cash cover for short put and stocks for short calls.

cheers.

LikeLike

Hey Raymond, hope all is going well for you!

For IBKR cash account that I am using, I will need the collateral to cover for short put and shares for the short call. Even doing PMCC for LEAPS, will require you to have enough collateral to cover the purchase of the long call before you can execute the short call position.

LikeLike

Thanks for the reply. That’s very inefficient use of capital. You might want to seek higher levels of option trading access. I understand you frown on the use of margin but margin in option is quite different from margin in stocks. It is better viewed as collateral requirement To put up collateral even for a long option position is quite ridiculous if you ask me. It could also be the reason why you were not able to do more to salvage your LEAPS such as selling calls aggressively as it would mean selling naked calls which is not possible with your account type. Without full access, you were not able to explore other repair trades and in many ways it also hampers your ability to improve and expand your option knowledge. The analogy is like someone putting up a high wall around a house to protect from being robbed leaving only a very small doorway. One day there is a big fire in the house and the occupants of the house all rushed to the only small doorway as the walls were too tall for them to scale over. Unfortunately, some were not able to get out in time.

I am usually not so generous with my sharing. But you have been generous with your sharing and I thought appropriate to reply in kind.

Cheers.

Raymond.

LikeLike

Hey Raymond, thanks so much and really appreciate your generous sharing, guess what, I just applied for a margins account….LOL 🙂 But the reason is because I wanted to do vertical spreads, which is kind of like selling naked call if one leg expires ITM. I will seriously consider your suggestion, thank you very much 🙂

LikeLike

Hi. Is it easy to get higher access on IBRK? Did you manage to get it? TOS is very strict when it comes to granting higher option access. Thinking of switching brokers. Cheers.

LikeLike

Oh, I managed to get approved within a day, buying power was around $1M, available funds 273k and SMA 243k.

LikeLike

Thats great. Cheers.

LikeLike