Recently, a popular Russian financial YouTuber (74k subscribers) by the name Sasha Yanshin, made 2 videos attacking another popular YouTuber, Chicken Genius Singapore, accusing him of giving dangerous financial advice and being a scammer who tried to sell people get-rich-quick options courses.

I think no matter which side we are on or who we think is more right than wrong, it is useful to dig deeper, beyond the hate and accusations, and learn the critical pointers that these two YouTubers are trying to bring across to us. So, this article aims to seive out the good from the bad and the ugly.

Background

For people who do not know who is Chicken Genius Singapore aka Ken Teng, he is a very popular Singaporean YouTuber (with 295k subscribers) who was one of the few YouTubers to talk about the potential explosive growth of Tesla 2 years ago.

He is probably the only financial YouTuber who does YouTube without wanting to earn anything out of it because he donates his YouTube ad revenue to help animals and he does not have any sponsors, course memberships, paetron page, affliate links on his YouTube channel. I truly believe that his purpose in life comes from helping people succeed and making the world a better place, which explains his popularity.

Around 3 months ago, he decided to quit YouTube after suffering mentally from the politics arising from the hate and criticism received from other fellow YouTubers as well as the massive pressure that he shoulders upon himself trying to help the people who supported him.

Ken went off the YouTube scene for a good 3 month break where he traveled around the world and is currently still traveling in Bali. He even made peace with his nemesis.

10 days ago, he posted a short video talking the stock market crash, which sort of signifies his comeback to the YouTube scene.

The Saga Begins

On 20th June 2022, Ken posted this video to explain why investors should not buy the dip. Ken explained that for every one dollar the central banks injected through Quantitative Easing (QE), the stock market went up one dollar. If the fed removes one dollar through Quantitative Tightening (QT), the stock market will drop by one dollar.

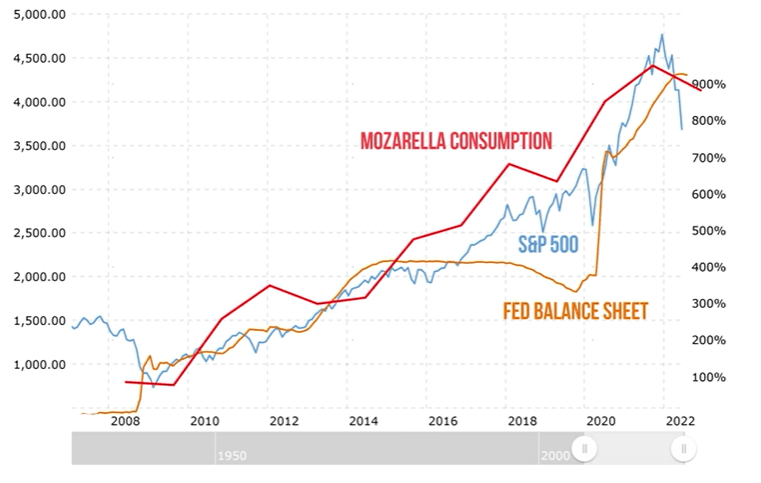

Ken also compared 2 graphs to show the correlation of Fed’s Balance sheet and stock market (S&P 500) share price since 2008.

Ken cautioned that as the Fed plans to remove 2 trillion dollars, this means the stock market will drop by a lot. He advised investors not to fight the central banks and buy the dip, until they stop removing money or when there is rumor that they will stop removing money to slow inflation.

Sasha’s Reaction Video

Sasha Yanshin then posted a video in response to Ken’s video, stating that he gave some incredibly stupid and very dangerous advice.

He rebutted the theory on the correlation of the Fed’s balance sheet and the stock market price by showing periods where they did not correlate.

He then went on to mock this theory by suggesting that the graph that measures the consumption of mozzarella is a better predictor of the share price of S&P 500 than the Fed’s balance sheet.

Then It Starts To Get Personal

The next 2/3 of the video is no longer about refuting the point on the correlation between the Fed balance sheet and the stock market price.

It is about the background and integrity of Chicken Genius, on how he built his fortune through selling people get rich quick options trading courses that are illegal in the US or UK.

In the last segment, Sasha talked about how Ken was asking people to buy the dip from Jan to March this year, even after the war in Ukraine has started, as well as how he was wrong in predicting a V-shaped recovery some months ago.

Ken’s Response

Ken responded to Sasha’s accusation by posting this video to share his stand.

He shared a graph that shows the S&P 500 share price and the net liquidity injection by the Fed. He explained that a 2 trillion sell order does not equate to the stock market going down by 2 trillion, as billions of luna got wiped out with a 300 million dollar sale order. When there’s a sell order, the orders need to be fulfilled and this is called liquidity. If there is less liquidity, the worse it gets as it may take a lower price to fill the orders.

Ken concluded by saying his whole intention is to simplify things so that most people can understand but he gets a lot of hate because some people don’t understand this and they take his comments out of context.

Sasha Strikes The Second Blow

Sasha posted another video and it was full of firepower again.

He again pointed out that the net liquidity injection and S&P 500 do not correlate, especially in 2018 and 2020 (highlighted in red boxes), where liquidity drops but share prices rise.

He then commented that Ken has no idea how QT works because, in QT, there are no sell orders to fill. In the QE program over the last two years, the Fed did not buy stocks but bought bonds, bond-based securities, and mortgage-backed securities instead, with the free money that they printed.

In QT, the strategy is to wait for the existing assets held on the balance sheet to mature and then write them off. When the treasuries that the Fed owns reach their maturity, the Fed then pays those back to themselves and effectively deletes the money from the system and reduces the balance sheet. So, the Fed is not selling any stocks there are no sell orders being placed.

Also, unlike QE where money quickly found its way into the system, the effects of QT will take a longer time as the Fed is not doing any active tightening. The Fed will start off with a 30 billion reduction per month from June to Aug, followed by a 60 billion reduction from September onwards until the end of 2023, as per the current plan.

Sasha also explained that he agreed with Ken that the market outlook in the coming months is not that great but the stock market is affected by a huge number of factors every day, from long-term macroeconomic variables to short-term news. To simplify it down to say that one factor trumps everything else and other factors are irrelevant showed that he (Ken) does not understand the financial market well.

A Scammer With A Big Fan Base Put Up On A Pedestal

In the last segment of the video, Sasha went on to highlight all the previous calls by Ken to buy the dip and not buy the dip, as well as the failed investment in nano coin.

He went on to make more personal attacks by warning the supporters of Chicken Genius Singapore that Ken is not their friend or financial advisor and he is simply a guy who hates people who sell investing courses on youtube, but he himself is selling a much more disgusting options trading course with pathetic claims of huge returns with no requirement to do any work. And in doing so, Ken shafted people and stole their money by selling get-rich-quick courses.

He concluded in his video that Ken only talks about his one epic trading win in Tesla and somehow forgets to mention the huge losses and warned everyone to be very careful as a scammer with a big fan base will still be put up on a pedestal by the dedicated followers.

Concluding Thoughts

I personally think that Sasha made a very good counterargument against Ken’s point on the relationship between Federal Reserves’ balance sheet and the stock market price movement. However, Ken’s 1 min plus videos are too brief and information presented may be taken out of context because they are subjected to everyone’s interpretation. For example, Ken could mean that the low liquidity caused huge price fluctuation and not just share price going downwards, it could go up as well in a bull market.

However, Sasha’s accusations and attacks on Ken, calling him a moron, liar, and scammer are totally uncalled for. Digging into Ken’s past and using something that he is not doing anymore against him is hitting below the belt and an act of cyberbullying. There is no evidence that Ken’s previous students were scammed, nor were there reports that the course members felt cheated after attending his course. The course content was not fairly reviewed/ critiqued and it is just a pure baseless one-sided accusation that the course was not useful and out to con people off their hard-earned money.

If Sasha could be more objective and not make a personal attack, I think he would have earned more respect not just from the neutrals but from Chicken Genius’ supporters as well. Shaming people online goes to show a lot about his own character.

I hope you find this sharing useful and I think one important lesson that I learn is that you (not your mentor or idol) are responsible for your own money. And to always exercise critical and logical thinking in your own investment decisions and not blindly follow anyone. Every one of us has different commitment, level of wealth and risk tolerance. Losing $100,000 may be peanuts to a billionaire but it could mean losing a lifetime’s worth of savings for someone who is not so well-to-do. So, be thankful for all the info shared but count on yourself to make the best decisions.

<< Subscribe to my blog to have all these articles delivered directly to your email address >>

*** SEE MY TRADES & PORTFOLIO ON PATREON ***

If you are interested to find out more about my options trades and investment portfolio, I will be updating them on Patreon (on the same day I made the trades), so do follow me there if you need some reference or inspiration.

*** EARN FREE MONEY ***

Sign up for WeBull Securities Brokerage and sure-win free shares:

Receive Free Money When You Sign Up With WeBull Securities Platform

*** FREE BEGINNER GUIDE TO OPTIONS TRADING ***

Keen to learn about options trading but do not wish to pay for expensive courses, this newbie guide will help gain the knowledge and fundamentals to understand options better. And it’s totally free!

The Newbie’s Guide To Options Trading

*** FREE MOTIVATIONAL BOOK ***

If earning more money from your investment does not excite you anymore, you may be seeking a purpose that brings fulfillment and meaning in life. I have written a motivational book that may be useful to you in some ways. You can also download a free copy here:

https://learninginvestmentwithjasoncai.com/finding-the-magical-realm-of-happiness-motivational-book

*** FOLLOW US ON SOCIAL MEDIA ***

Follow me on Facebook, LinkedIn, to get notified of my latest posts on social media. Or subscribe to my blog (scroll to the bottom of the page) to have my new posts sent directly to your mailbox.

*** BUY ME A CUP OF COFFEE ***

If my blog has benefited you in some ways and you would like to offer a token of appreciation, you may do so via this page. Thank you very much for your support!

*** MUST-READ BLOG POSTS ***

After accumulating more than 600k of unrealized losses on my portfolio, I wrote this article to encourage friends and investors who are also losing a lot of money to the market.

If You Are Feeling Depressed From Losing Lots Of Money In The Stock Market, Here’s An Article For You

In the 10 years of my investing journey, I have made many mistakes but also learned many lessons from these mistakes. I compiled the 10 most valuable lessons that I have learned and may they help you succeed in your investing journey.

Happy 10 Years Of Investing | 348k (Realised) Profit, 635k (Unrealized) Loss & 10 Lessons Learnt

The precious 6 lessons I learnt after cutting more than half a million of losses in the stock market through bad investments and risky trades.

6 Lessons Learnt After Losing 551k In 10 Years Of Investing & Options Trading | What Newbies Should Know They Start Investing/ Trading

How I managed to build a 1M investment/ trading portfolio despite coming from humble beginnings.

How A Poor Kid Got To A 1M Investment Portfolio | Tips & Principles Of Building Wealth

I did these 10 side hustles while holding a full-time job, so I share them here so you can be inspired to grow your wealth through a side hustle that you enjoy.

I Did These 10 Side Hustles While Working Full Time | 10 Side Hustle Ideas To Help You Earn An Extra Income

Struggling with inflation and high cost of living? Try these 10 methods to help you save money and accumulate more savings for investments or rainy days.

10 Ways To Save Money To Help You Fight Inflation & Rising Costs Of Living

Why I am building $120,000 of cash reserves in Singapore Savings Bonds (SSB) & 5 reasons why I think SSB is a worthy low or zero-risk investment that you can consider.

Why I Am Building $120,000 Of Cash Reserves In Singapore Savings Bonds (SSB)? | 5 Reasons Why SSB Is A Worthy Low-Risk Investment

Sharing why I am doing Dollar Cost Average (DCA) into SPY and QQQ ETF for long-term investments and a step-by-step guide to doing it automatically with Interactive Brokers.

Why I Am Doing DCA (Automatically) For SPY & QQQ For My Long Term Investment? (20% ~ 30% Upside Potential) | Step By Step Guide To Activating Automatic Recurring Investment On IBKR

Can options trading provide you with extra sideline income every month? In this post, I share my experience of generating income from options trading over the last 3 years.

Options Trading For Passive Income: Truth Or Myth?